Filing an insurance claim can be a daunting experience — especially if you’re a first-time driver. Whether it’s a fender bender or a more serious accident, knowing how to navigate the claims process can help you avoid costly mistakes and ensure a smoother experience. This guide will walk you through the step-by-step process of filing a claim, common pitfalls to avoid, and smart tips to handle everything like a pro.

What Is an Insurance Claim?

An insurance claim is a formal request you make to your insurance provider to compensate you for damages, injuries, or losses covered under your policy. For new drivers, understanding this process is essential to getting the most from your coverage when an incident occurs.

When Should You File a Claim?

Not all accidents require a claim. Filing one for a minor scratch could raise your premiums unnecessarily. However, you should file a claim when:

- The damage or injuries are significant

- Another party is involved and there’s liability concern

- You’re unsure of the repair costs

- You need to use your comprehensive or collision coverage

Step-by-Step: How to File a Car Insurance Claim

- Stay Safe: Move to a secure location and check for injuries.

- Call the Police: File a report even for minor accidents—it’s often required for claims.

- Document Everything: Take photos of damage, location, license plates, and insurance details.

- Contact Your Insurer: Call your insurance company or file a claim online or via app.

- Submit Evidence: Upload or send accident photos, reports, and other documentation.

- Cooperate With Adjuster: Your insurer will assign an adjuster to assess the damage and guide you.

- Follow Up: Stay in touch with your insurer until the settlement is finalized and repairs are complete.

Common Mistakes First-Time Drivers Make

- Admitting fault at the scene

- Not calling the police or getting a report

- Delaying the claim process

- Failing to document damage thoroughly

Claim Filing Tips for First-Time Drivers

- Always keep a copy of your insurance policy in the car

- Use your insurer’s mobile app for fast documentation uploads

- Ask about rental car reimbursement while your vehicle is being repaired

- Stay calm and professional when speaking with claim adjusters

Understanding Different Types of Claims

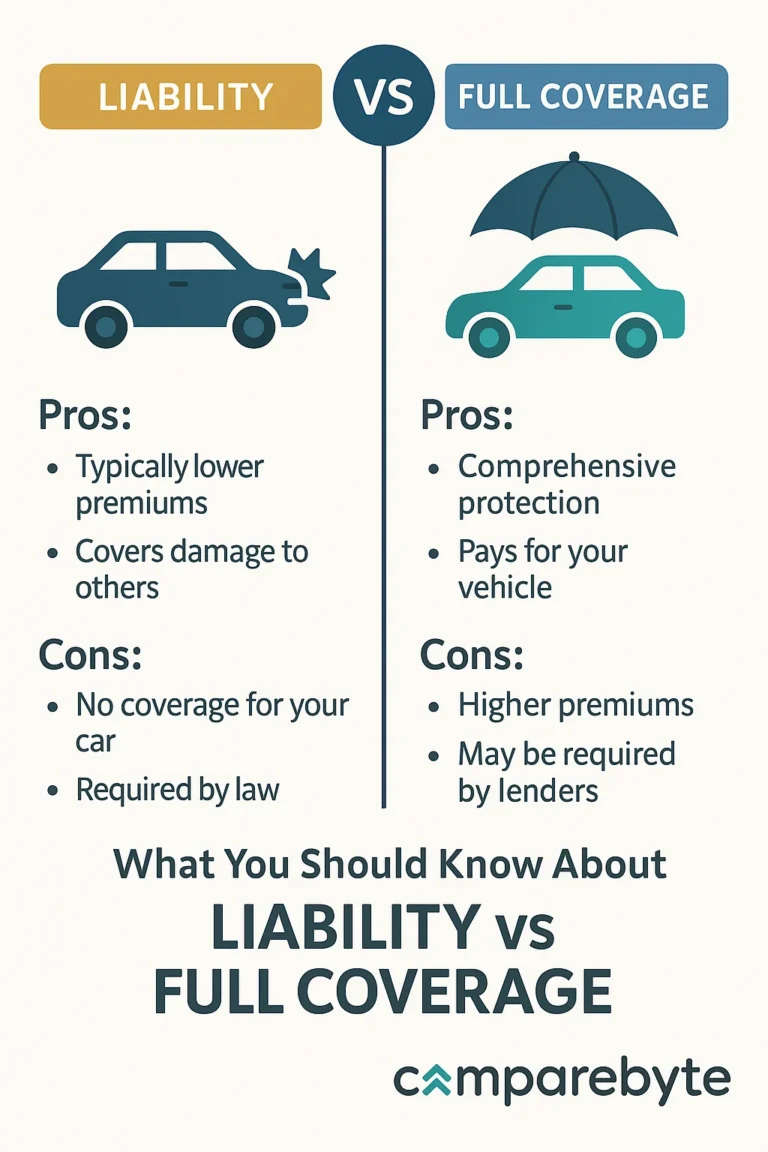

1. Liability Claims

If you caused the accident, this covers the other driver’s injuries and property damage.

2. Collision Claims

Covers damage to your own vehicle, regardless of who was at fault.

3. Comprehensive Claims

Covers non-collision incidents like theft, vandalism, or natural disasters.

Conclusion

As a first-time driver, learning how to file an insurance claim can feel overwhelming — but it doesn’t have to be. With the right preparation and understanding of the process, you can protect your rights, reduce stress, and ensure a fair outcome. Bookmark this guide so you’re never caught off guard again!