Online insurance marketplaces have revolutionized how individuals and families shop for coverage. Whether you’re looking for auto, health, life, or renters insurance, these platforms offer a centralized way to compare multiple policies from various providers. Instead of visiting individual insurance company websites or speaking with several agents, consumers can simply input their details and receive quotes side by side. This approach not only saves time but often helps users find better deals tailored to their unique situations.

How Do Online Insurance Marketplaces Work?

The concept is relatively simple. Users fill out a form providing their age, location, desired coverage, and other relevant factors. The marketplace then leverages algorithms and partnerships with insurers to generate real-time or near-real-time quotes. This process is similar across many types of insurance – from auto coverage for teens to health insurance for freelancers.

Benefits of Using an Online Insurance Marketplace

- Convenience: A one-stop-shop for comparing plans.

- Cost Savings: Ability to view competitive pricing across providers.

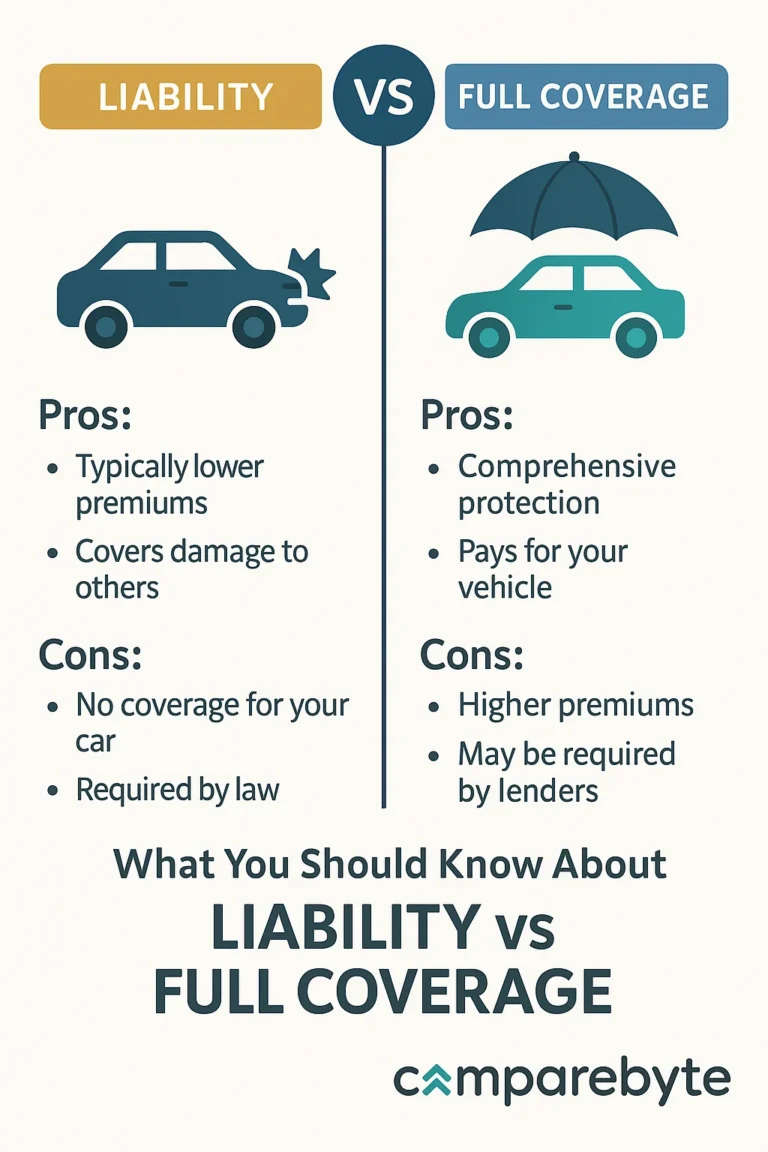

- Transparency: Easy comparison of deductibles, coverage limits, exclusions, etc.

- Real Reviews: Some marketplaces offer user-generated reviews and ratings.

- Educational Resources: Tools like calculators, blogs, and glossary sections aid decision-making.

Limitations to Be Aware Of

While these platforms are powerful, they’re not perfect. Many marketplaces do not include all insurers, especially smaller or regional providers. This means you might miss out on a policy that could be ideal for your needs. Additionally, some marketplaces prioritize certain companies based on paid partnerships, which can skew visibility.

Types of Insurance You Can Compare Online

- Auto Insurance

- Health Insurance (Marketplace & Private)

- Life Insurance

- Homeowners & Renters Insurance

- Travel Insurance

- Pet Insurance

- Dental & Vision Insurance

Feature Comparison Table

| Marketplace | Types of Insurance | Mobile App | Average User Rating |

|---|---|---|---|

| Policygenius | Life, Home, Renters, Auto | ✅ | 4.8/5 |

| The Zebra | Auto, Home | ✅ | 4.5/5 |

| Compare.com | Auto | ❌ | 4.2/5 |

| eHealth | Health, Dental, Vision | ✅ | 4.6/5 |

Are Online Marketplaces Safe?

Security is a valid concern. Reputable marketplaces use SSL encryption and secure forms to protect your data. Look for “https://” in the URL and a privacy policy that outlines how your information will be used.

Red Flags to Avoid

- Unsolicited follow-up calls immediately after form submission.

- Lack of clarity on how data will be shared.

- Too-good-to-be-true offers from unverified companies.

Tips for Maximizing Value

To make the most out of an online marketplace:

- Use more than one site – don’t rely on a single aggregator.

- Input consistent data for accurate comparisons.

- Read the fine print – check for hidden fees or coverage limits.

- Take advantage of filters to narrow down by premium, deductible, or insurer rating.

- Consult an agent if your needs are complex (e.g., high-risk drivers, pre-existing conditions).

Final Thoughts

Online insurance marketplaces have made shopping for coverage more accessible than ever. While they aren’t perfect, their benefits in terms of convenience, cost-effectiveness, and transparency make them an invaluable tool in the digital age. Be informed, stay safe, and use these platforms wisely to secure the best insurance for your situation.