Car ownership comes with responsibilities—and risks. If your vehicle is totaled or stolen, you may end up owing more on your loan or lease than your insurance will cover. That’s where Gap Insurance comes in.

This comprehensive guide will walk you through the fundamentals of Gap Insurance in simple language. You’ll also explore the top providers and learn how to determine if this type of coverage is right for you.

What Is Gap Insurance?

Gap Insurance, short for “Guaranteed Asset Protection,” covers the difference between what you owe on a car loan or lease and what your standard auto insurance pays if the car is totaled or stolen. It is especially useful for people who finance or lease their cars.

Imagine buying a brand-new car for $30,000. After a year, you still owe $25,000 on the loan, but the car’s market value has dropped to $20,000. If the car gets totaled, your insurer pays the current market value—$20,000. That leaves a $5,000 gap. Gap Insurance covers that difference.

It’s not mandatory, but lenders may require it for certain types of loans. It’s available through dealers, lenders, and many insurance companies.

Keep in mind, it only covers the vehicle—not injuries, repairs, or other losses. And it typically expires when your loan is paid off or your lease ends.

Gap Insurance is often affordable, but prices and coverage vary greatly by provider and policy type.

Step-by-Step: How Gap Insurance Works

Step 1: Purchase or Lease a New Car

When you buy or lease a new car, its value depreciates as soon as you drive it off the lot. This immediate loss in value creates a potential gap between your car’s worth and what you owe on it.

Step 2: Choose to Add Gap Insurance

Gap Insurance can be added during the car purchase process through your dealer or separately via your auto insurance provider. It’s best to shop around for the most cost-effective option.

Step 3: Make Monthly Payments

You’ll continue to make monthly payments on your vehicle and your Gap Insurance (if paid over time). Some lenders bundle this into your auto loan.

Step 4: If the Car Is Totaled or Stolen

In the unfortunate event of a total loss, your comprehensive or collision insurance pays out the car’s current market value. If that amount is less than what you owe, the Gap Insurance kicks in.

Step 5: The Gap Is Covered

Gap Insurance pays the difference between the insurance payout and your remaining loan or lease balance. This prevents you from owing money on a car you no longer have.

Top 7 Gap Insurance Providers

1. Progressive

Progressive offers Loan/Lease Payoff Coverage, which functions similarly to Gap Insurance. It covers up to 25% more than the car’s actual cash value in the event of a total loss.

2. GEICO

GEICO doesn’t offer Gap Insurance directly but partners with lenders and may help you access it during policy setup. Ideal for low-premium seekers.

3. Allstate

Allstate provides both standalone Gap Insurance and lease/loan gap coverage options, especially convenient if you bundle with auto insurance.

4. State Farm

Known for strong customer service, State Farm’s Gap coverage is available only with its vehicle loans. It’s best suited for customers who finance through them.

5. Nationwide

Nationwide offers optional Gap coverage add-ons and is a good choice for people seeking comprehensive financial protection with flexible terms.

6. USAA

USAA serves military members and their families, offering affordable Gap Insurance and strong claims support, making it ideal for those eligible.

7. Car Dealerships

Dealerships often offer Gap Insurance during purchase. It’s convenient but may be more expensive than buying from an insurer.

Common Mistakes and How to Avoid Them

Ignoring Depreciation

New cars depreciate quickly. Failing to account for this can leave you financially exposed in the event of a loss. Always check how fast your car’s value may drop.

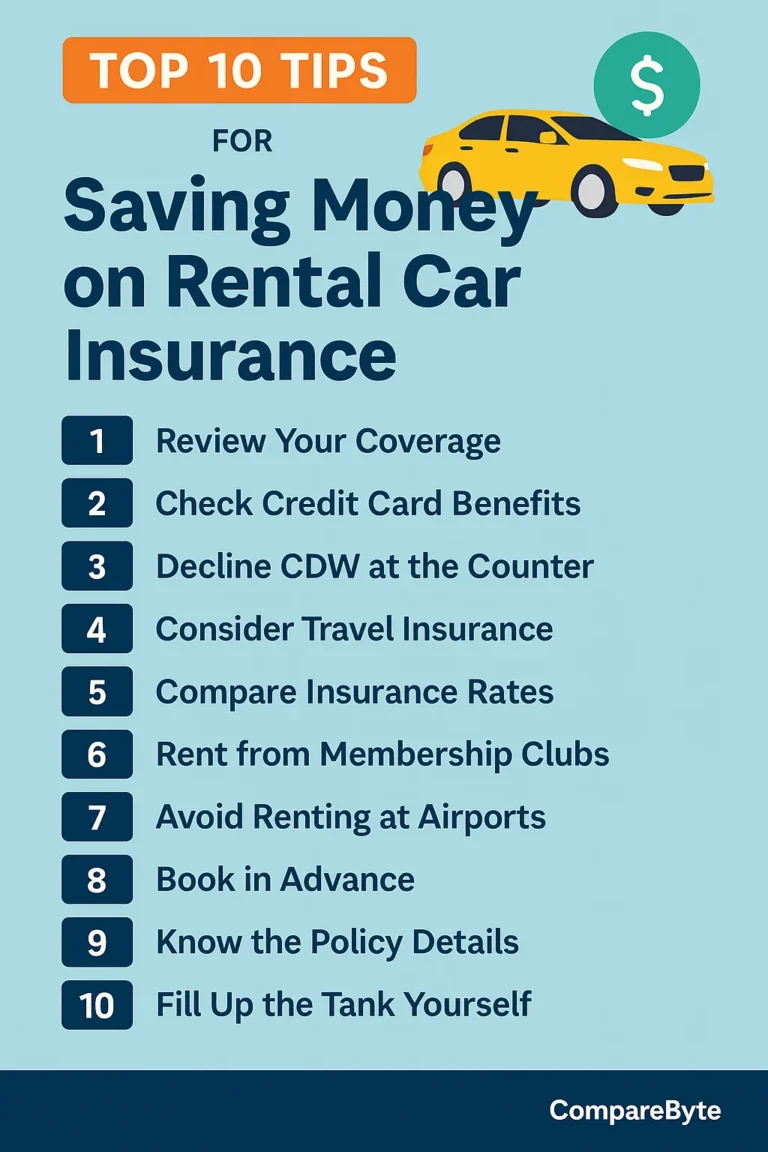

Not Comparing Providers

Gap Insurance prices vary. Don’t accept the dealer’s offer without comparing options from at least two insurance companies.

Buying It Too Late

Waiting too long after your vehicle purchase may disqualify you from getting Gap Insurance. Most insurers have time or mileage limits.

Thinking It Covers Everything

Gap Insurance does not cover injuries, vehicle repairs, or negative equity rolled into your loan from a previous vehicle. Read the fine print carefully.

Paying Too Much

Dealers may charge more for Gap Insurance than insurance companies. Ask for a breakdown and consider outside options to save money.

Gap Insurance Comparison Tables

| Provider | Average Cost | Availability | Bundling Discount |

|---|---|---|---|

| Progressive | $20/month | All states | Yes |

| GEICO | Varies | Limited | No |

| Allstate | $15/month | Nationwide | Yes |

| Scenario | Without Gap Insurance | With Gap Insurance |

|---|---|---|

| Car is totaled | Owe $5,000 out-of-pocket | No out-of-pocket cost |

| Car is stolen | Insurance payout < loan balance | Gap covered by insurer |

Frequently Asked Questions

Is Gap Insurance required by law?

No, Gap Insurance is not required by law. However, your lender or lease provider may mandate it for high-value or low-down-payment vehicles.

Can I cancel Gap Insurance?

Yes. Most insurers allow cancellation once your loan balance is lower than your car’s value. Check the policy’s terms and potential refund options.

Is Gap Insurance worth it for used cars?

Usually not. Used car insurance options typically don’t leave a large gap between value and loan amount unless the car was financed with a small down payment.

Conclusion

Gap Insurance can be a financial lifesaver in situations where your car is totaled or stolen and your standard auto insurance falls short. While not always necessary, it offers peace of mind, especially for those leasing or buying new cars with small down payments.

Explore your options from different providers and don’t rush the decision. Compare, calculate your risk, and choose what best fits your financial situation.

Want to explore more? Check out our detailed guides on Loan vs Lease Comparison and Auto Insurance for New Drivers for more insights.

Take control of your car ownership journey—compare your Gap Insurance options today and drive with confidence.

External sources: Progressive Loan/Lease Coverage, GEICO Official Site, USAA