Paying for college is already expensive, and for students who also own a car, auto insurance premiums can put a serious dent in their limited budgets. Fortunately, many insurance providers offer discounts specifically designed for **college students**. These savings can significantly reduce monthly costs and make car ownership more manageable.

This guide explores the different types of **car insurance discounts** available to **college students**, the requirements for each, and how to effectively apply them. If you’re a student—or the parent of one—this article will help you take full advantage of the opportunities to save.

Understanding Why Insurance Is Expensive for Young Drivers

It’s no secret that young drivers typically pay higher car insurance rates. This is due to a combination of inexperience, statistically higher accident rates, and risk factors that insurers calculate when determining premiums. Being a college student often places you in the most expensive demographic bracket.

However, not all young drivers are the same. Insurers recognize that responsible behaviors such as maintaining good grades, attending school far from home, or driving less frequently can make a big difference. That’s where discounts come in.

Understanding the factors behind high premiums helps students better appreciate the benefits of these discounts. It also empowers them to modify behaviors or provide documentation that supports their eligibility.

Let’s take a closer look at what kinds of discounts are available and how to qualify for them.

Top Car Insurance Discounts for College Students

1. Good Student Discount

Most insurers offer a **good student discount** to full-time students under the age of 25 who maintain a B average (3.0 GPA or higher). This reflects the correlation between academic responsibility and safe driving habits.

How to Qualify

You’ll need to provide recent report cards or transcripts to your insurance company. Some insurers may require verification each semester or annually.

2. Distant Student Discount

If you attend school more than 100 miles from your home and don’t take your car with you, you may qualify for a **distant student discount**. This reflects the reduced likelihood of using the vehicle regularly.

How to Qualify

Documentation from your college and proof of residence at your dorm or school apartment may be needed. Some providers also request mileage logs or signed declarations.

3. Usage-Based Insurance (UBI)

UBI programs track driving habits using telematics devices or apps. Students who drive safely can earn **significant discounts**, sometimes up to 30% or more.

How to Qualify

Enroll in your insurer’s UBI program and allow data tracking. Safe behaviors like smooth braking and low mileage will contribute to better rates.

4. Multi-Policy Discounts

Bundling your **auto insurance** with renters or health insurance through the same provider can unlock additional savings.

How to Qualify

Request a quote that includes bundled services, or use the same provider for your family’s home or life insurance.

5. Defensive Driving Course Discount

Taking a certified defensive driving course can not only teach you valuable skills but also earn you a **policy discount**.

How to Qualify

Complete an accredited course and submit the certification to your insurance company. Some providers offer their own online versions.

6. Low-Mileage Discount

If you drive infrequently—common for students living on campus—you may qualify for a **low-mileage discount**.

How to Qualify

Maintain mileage records and report accurate odometer readings during policy renewal or UBI enrollment.

Common Mistakes Students Make When Seeking Discounts

Not Asking for Available Discounts

Many students miss out simply because they don’t ask or assume they won’t qualify. Always speak with your insurer about what you may be eligible for.

Letting GPA Drop Below Threshold

A slight dip below a B average could cause the good student discount to be revoked. Stay consistent with academic performance to retain benefits.

Failing to Submit Documentation on Time

Discounts often require timely submissions of proof such as transcripts, course certificates, or residence documents. Set reminders to meet these deadlines.

Not Comparing Providers

Different insurers offer different discounts and savings programs. Students should compare policies and quotes annually to ensure optimal savings.

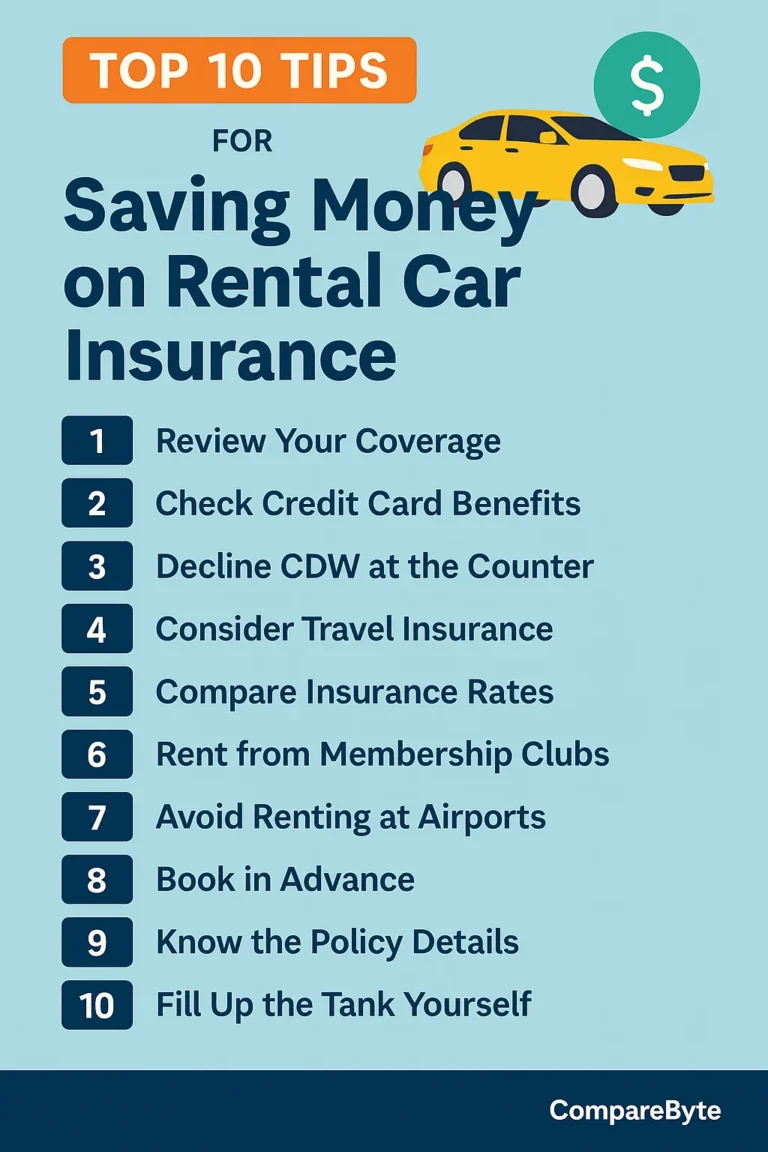

Comparison Tables

| Discount Type | Requirements | Average Savings |

|---|---|---|

| Good Student | GPA 3.0+, full-time enrollment | 10% – 25% |

| Distant Student | 100+ miles from home, no car on campus | 10% – 30% |

| UBI Program | Safe driving via telematics | Up to 30% |

| Insurer | Popular Discounts | Website |

|---|---|---|

| Geico | Good Student, Defensive Driving | geico.com |

| State Farm | Distant Student, Multi-Policy | statefarm.com |

| Progressive | UBI, Low Mileage | progressive.com |

Frequently Asked Questions (FAQ)

Can I get more than one discount?

Yes! Many insurers allow discounts to be combined. For example, you can stack a good student discount with a UBI program.

How long do student discounts last?

Typically until age 25, as long as you remain a full-time student and maintain eligibility.

Do all insurance companies offer the same discounts?

No, discount offerings vary. Always compare multiple providers to see which has the best deals for students.

Conclusion and Summary

Auto insurance doesn’t have to break the bank for college students. By leveraging **student-specific discounts**, you can dramatically lower your monthly premiums. From maintaining good grades to enrolling in UBI programs, every small effort counts toward savings.

Don’t forget to review your policy every semester and provide updated documentation to keep your discounts active. For more tips, explore our articles on Complete Guide to Student Auto Insurance and Best Insurance Companies for Young Drivers.

If you’re unsure where to begin, visit trusted sites like NAIC.org or Consumer Reports Insurance Guide for more independent information.