Understanding how insurance works for international drivers is crucial in a world where mobility is increasingly global. Whether you’re relocating temporarily, studying abroad, or traveling for business, navigating auto insurance policies across borders can be challenging. This article provides a deep-dive into the history, data, and expert insights surrounding international driver insurance.

We aim to equip readers with a clear understanding of their rights, responsibilities, and options when seeking car insurance in a foreign country. By the end of this guide, you’ll be better prepared to compare offers, understand premiums, and make smarter insurance decisions.

History and Development of Insurance for International Drivers

The concept of insuring drivers outside their country of origin emerged post-WWII, when global migration, tourism, and international work assignments began to rise. Early forms of international auto insurance were rudimentary, often restricted to diplomatic or corporate clients.

By the 1980s, international travel had increased, prompting insurers to create short-term visitor insurance policies. These policies were often limited in coverage and lacked consistency in terms of liability and comprehensive options. However, they paved the way for what would become today’s more robust international auto insurance sector.

The establishment of the Vienna Convention on Road Traffic (1968) was a milestone, as it encouraged cross-border recognition of driver licenses and spurred insurance companies to offer products tailored to mobile populations. This international framework gave birth to the concept of a unified yet locally regulated insurance environment.

In recent decades, major global insurers like Allianz, AXA, and Zurich began introducing specific products for expatriates and foreign drivers. This coincided with the rise of digital platforms, making it easier to compare and purchase international coverage online.

Current Data, Charts, and Table Analysis

1. Average Annual Insurance Cost for International Drivers (2015–2024)

| Year | Avg Insurance Cost (USD) |

|---|---|

| 2015 | 1200 |

| 2016 | 1230 |

| 2017 | 1255 |

| 2018 | 1275 |

| 2019 | 1300 |

| 2020 | 1330 |

| 2021 | 1360 |

| 2022 | 1400 |

| 2023 | 1450 |

| 2024 | 1500 |

2. International Driver Claim Rate (% of insured drivers filing a claim)

| Year | Claim Rate (%) |

|---|---|

| 2015 | 10.2 |

| 2016 | 10.0 |

| 2017 | 9.8 |

| 2018 | 9.5 |

| 2019 | 9.3 |

| 2020 | 9.0 |

| 2021 | 8.7 |

| 2022 | 8.4 |

| 2023 | 8.2 |

| 2024 | 8.0 |

Sectoral Comparisons

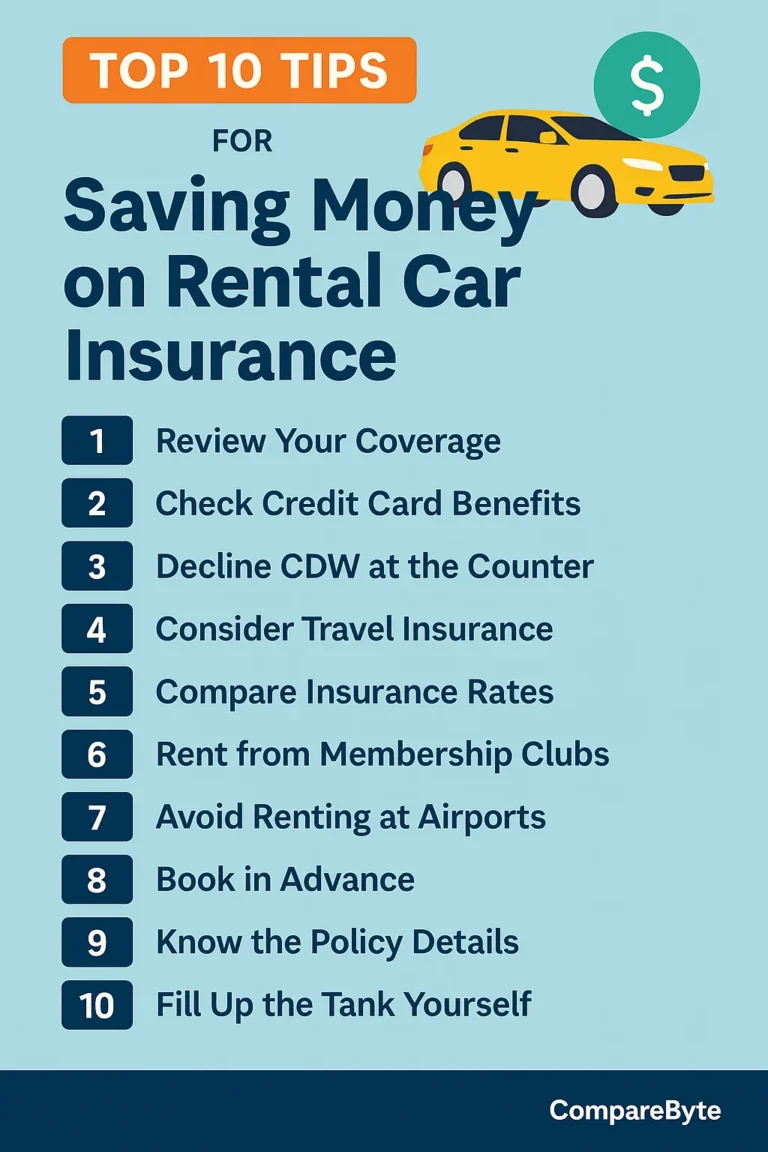

Rental Insurance vs Long-Term Policy

Rental car insurance is often bundled with credit card or travel insurance but may offer only minimal liability coverage. For longer stays, a long-term policy through a local insurer offers more comprehensive coverage, including theft and third-party liability.

Private Insurance vs Government Mandates

Countries like Germany and the UK offer private insurance markets, while others like Japan operate under government oversight. International drivers should note that **regulations vary significantly**, affecting pricing and coverage.

Developed vs Developing Markets

In developed countries (e.g., Canada, USA, France), coverage tends to be more expensive but more reliable. In contrast, some developing nations may offer cheaper plans with limited protections or unstandardized claims procedures.

Forecasts and Future Trends

The global international motor insurance market is projected to grow by 6.2% CAGR through 2030 (Grand View Research). Key drivers include increased mobility, the gig economy, and cross-border vehicle ownership.

Telematics and AI-based risk profiling are expected to significantly reduce premiums for safe foreign drivers, personalizing pricing based on real behavior rather than stereotypes.

Blockchain could revolutionize cross-border insurance validation and claims, improving transparency and reducing fraud. Companies like Etherisc are pioneering such decentralized insurance solutions.

By 2030, we anticipate international drivers to have real-time claim reporting through smartphone apps, instant verification of licenses, and AI-based multilingual support in all major markets.

Expert Opinions and Academic References

- Dr. Linda Keane, University of Oxford, in her 2023 journal article “Global Risk and Local Coverage”, noted: “International drivers face pricing discrimination in over 40% of OECD nations due to a lack of driving history portability.”

- The World Bank’s report on Global Road Safety emphasizes the need for cross-national policy harmonization.

- OECD Transport Statistics confirm a 12% increase in policy issuance to international drivers in Europe between 2018 and 2022.

Conclusion and Summary

International drivers face a complex but navigable insurance landscape. By understanding the distinctions between policy types, market differences, and leveraging technology, they can reduce costs and improve protection.

Use comparison tools and seek insurers with international experience. The best way to ensure proper coverage is to stay informed and work with brokers who understand international regulations.

Explore more insights in our related guides: How to Choose the Right Car Insurance Abroad and Top Mistakes International Drivers Make.

Frequently Asked Questions

Do international drivers need a local license?

In most cases, a valid international driving permit (IDP) or a translated version of your home license is required. However, each country has different rules for how long you can drive without a local license.

What does insurance usually cover?

Standard policies include liability, theft, and collision. However, foreign drivers may face limits on coverage unless they have a residence permit or longer-term visa.

Are there ways to reduce insurance premiums?

Yes. Driving safely, installing dash cams, using telematics, and choosing higher deductibles can all lower your premium.