As electric scooters and e-bikes become increasingly popular, many riders are left wondering whether they need insurance for these modern modes of transportation. For beginners, this can be a confusing and overwhelming topic, especially given the growing number of regulations, providers, and policy types. This guide will break it all down in simple terms and help you decide whether or not insurance is right for your electric ride.

In this beginner-friendly guide, you’ll learn what electric scooter and e-bike insurance covers, the main benefits, drawbacks, and practical comparisons that can help you make an informed decision. Let’s ride into it!

What Is Electric Scooter and E-Bike Insurance?

Electric scooter and e-bike insurance is a specialized type of coverage designed to protect riders financially in case of accidents, theft, or damage. Unlike car insurance, this is often an optional product, though in some areas it may be legally required depending on the power and speed of your device.

There are various types of coverage available, from basic liability insurance to more comprehensive plans that also cover theft and personal injuries. While some homeowners or renters insurance policies offer partial coverage for personal property, they often exclude electric rideables used on public roads.

In most cases, electric mobility insurance is provided by third-party insurance firms, though some scooter and bike companies offer coverage through partners. As cities adapt to micromobility, this type of insurance is gaining traction.

It’s important to understand the difference between personal and commercial use. If you’re renting out scooters or using them for delivery services, your insurance needs will differ significantly from a casual commuter’s.

In short, this kind of insurance can provide peace of mind—but it depends on your usage, location, and the risk tolerance you’re comfortable with.

Types of Coverage Available

1. Liability Insurance

This covers bodily injury or property damage caused to others while operating your scooter or e-bike. It’s the most basic and often the most affordable option. Many cities require some form of liability coverage for public rideables.

2. Collision and Damage Protection

This covers repair costs if your scooter or bike is damaged in an accident. It’s particularly helpful if you’re using a high-end or fast e-bike, which can cost thousands to replace.

3. Theft and Vandalism Coverage

Given the portable nature of scooters and bikes, theft is a common concern. This policy ensures you’re not left out-of-pocket if your vehicle is stolen or intentionally damaged.

4. Personal Injury Protection (PIP)

PIP pays for medical expenses if you’re injured while riding, regardless of fault. It’s essential for those commuting daily in urban traffic where accident risk is higher.

5. Uninsured Motorist Coverage

If you’re hit by someone without insurance, this policy ensures your medical bills and bike repairs are still covered.

Pros and Cons of E-Scooter and E-Bike Insurance

| Pros | Cons |

|---|---|

| Financial protection in case of theft or damage | Additional monthly cost |

| Covers medical expenses and liability | Not always legally required |

| Peace of mind when commuting in traffic | Limited availability in some regions |

| May help in legal disputes after accidents | Policies vary and can be confusing |

| Custom plans available for personal and commercial use | Doesn’t always cover all damage types |

When Is It Worth Getting Insurance?

1. If You Commute Daily

Regular riders are at a higher risk of being involved in accidents. Daily commuting increases exposure, making insurance a smart investment.

2. If You Live in a High-Theft Area

Cities with high crime rates pose a real risk to your personal transportation device. Theft insurance can save you hundreds—or thousands—if your ride gets stolen.

3. If You Ride a High-End or Fast E-Bike

Premium models come with premium price tags. Replacing a damaged or lost ride without insurance can be devastating.

4. If You Rent or Operate a Fleet

Commercial use increases liability. Whether you’re running a delivery service or a rental fleet, commercial e-scooter insurance is essential for business protection.

5. If Required by Law

In some cities or countries, insurance may be mandatory based on power or top speed. Always check local laws before riding.

Example Scenarios and Coverage Comparisons

| Scenario | With Insurance | Without Insurance |

|---|---|---|

| Bike stolen while parked | Covered under theft insurance | No compensation |

| Minor collision, personal injury | Medical bills covered via PIP | Out-of-pocket expenses |

| Hitting a pedestrian | Liability insurance covers claims | Potential lawsuit and personal liability |

Frequently Asked Questions

Is e-scooter insurance mandatory?

In most countries, it’s not yet required. However, some cities are introducing rules that mandate minimum liability coverage for micromobility devices.

Can I add e-bike coverage to my home insurance?

Sometimes, yes—but it’s usually limited and doesn’t cover liability. You’ll want to double-check with your provider.

How much does electric scooter insurance cost?

Prices vary, but most plans start around $5–$15/month depending on your location, the type of coverage, and your scooter or bike model.

Conclusion: Should You Get Insurance?

If you use your scooter or e-bike regularly, live in a dense or high-theft area, or operate a high-value ride, getting electric scooter insurance is a smart move. The financial safety net it provides far outweighs the monthly premium in many real-world cases.

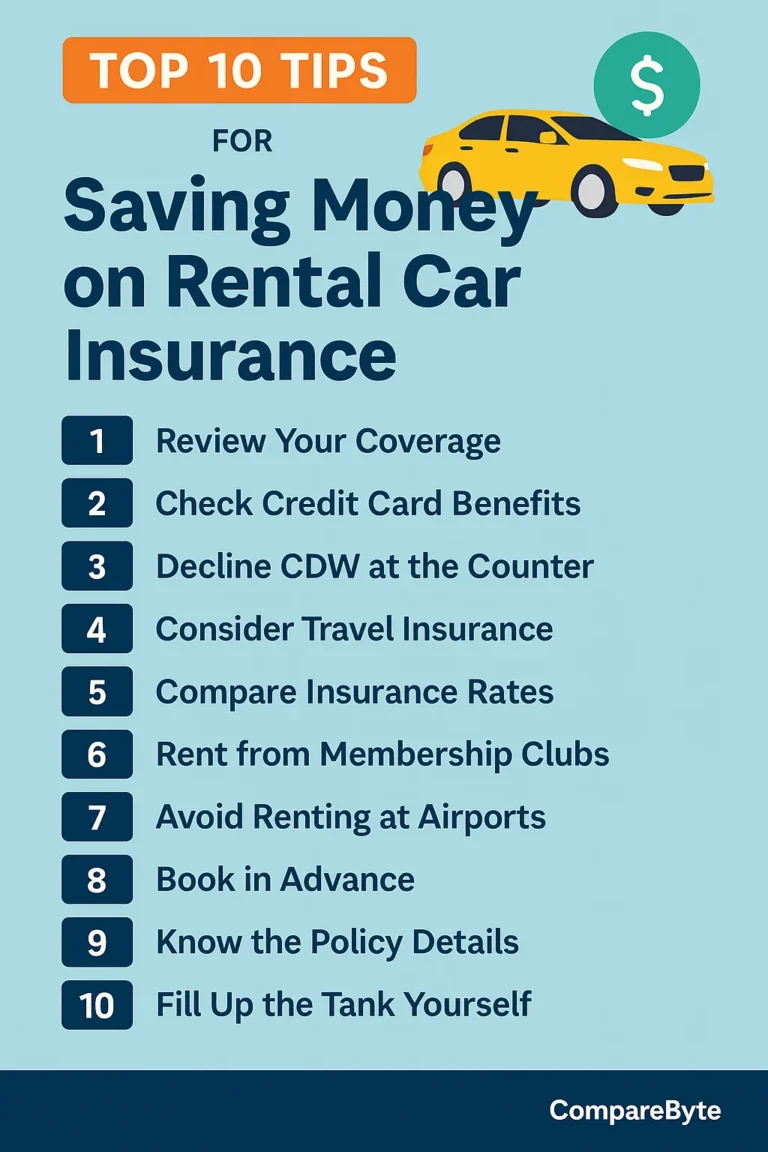

For beginners, start with a basic liability plan and upgrade as needed. Compare options from well-known providers like Progressive or Lemonade, which offer micromobility-friendly plans.

Still undecided? Read our guides on What Is Liability Insurance for Riders to explore more.

Don’t wait until it’s too late—protect your ride today!