Finding insurance with a suspended license can seem like an impossible task. Whether your license was suspended due to DUI, unpaid fines, or accumulated points, insurers see you as high risk. However, securing insurance is not only possible—it’s often required to reinstate your license or maintain financial responsibility.

This guide will walk you through the top 10 ways to find car insurance with a suspended license, along with what you need to know to navigate the process efficiently and legally. You’ll also gain valuable insights into pricing, policy types, and how to minimize long-term impact.

Understanding Suspended Licenses and Their Impact on Insurance

A suspended license means your driving privileges have been temporarily revoked. The reasons can vary—from serious violations like DUI to administrative reasons such as failing to pay child support or traffic fines.

Insurance providers see suspended licenses as red flags. Some may cancel your policy outright, while others may refuse to issue a new one. However, many companies offer specialized policies for high-risk drivers, including SR-22 insurance or non-owner coverage.

Before shopping for insurance, it’s crucial to know why your license was suspended and what requirements you need to meet for reinstatement.

This knowledge will shape the type of policy you should seek and the documentation you’ll need to provide.

Top 10 Methods for Finding Insurance with a Suspended License

1. Contact Specialized Insurance Providers

Not all companies deal with high-risk drivers, but some specialize in this niche. Providers like The General and Dairyland offer solutions for suspended drivers.

2. Seek SR-22 or FR-44 Coverage

If your state requires proof of financial responsibility, ask insurers about filing an SR-22 (or FR-44 in Florida/Virginia). This form confirms you carry the minimum required coverage.

3. Consider Non-Owner Car Insurance

Even without a car, you may need non-owner car insurance to meet reinstatement requirements. This policy provides liability coverage when driving vehicles you don’t own.

4. Shop Through Insurance Brokers

Brokers have access to a wide range of insurers and can find policies tailored for suspended license situations. This saves time and helps you compare offers efficiently.

5. Reevaluate Your Driving Record

Obtain a copy of your motor vehicle report (MVR). If the suspension was due to unpaid fines or administrative errors, clearing them may allow you to qualify for more favorable terms.

6. Bundle Your Insurance

Bundling home or renter’s insurance with car insurance can reduce the cost and make insurers more willing to take on a high-risk policy.

7. Demonstrate Risk Reduction

Completing a defensive driving course or attending DUI education classes shows insurers that you’re taking steps to improve your driving behavior.

8. Look into State Programs

Some states offer special insurance programs for high-risk drivers. Check your state’s department of insurance website for options.

9. Use Online Comparison Tools

Websites like Insure.com or Compare.com can help you find insurance policies that cater to suspended license holders.

10. Maintain Continuous Insurance Coverage

Even while your license is suspended, having coverage (like non-owner insurance) prevents lapses, which can increase premiums in the future.

Key Comparison Tables

Table 1: Common Reasons for License Suspension and Impact on Insurance

| Suspension Reason | Insurance Impact |

|---|---|

| DUI/DWI | Requires SR-22, significantly higher rates |

| Unpaid Fines | Policy might be reinstated upon payment |

| No Insurance | Insurer may require non-owner coverage |

| Excessive Points | Seen as high-risk; fewer policy options |

Table 2: Insurance Providers Offering Suspended License Coverage

| Company | Policy Type | SR-22 Available? |

|---|---|---|

| The General | High-risk auto | Yes |

| Dairyland | Non-owner, SR-22 | Yes |

| Progressive | Standard and SR-22 | Yes |

Common Pitfalls and How to Avoid Them

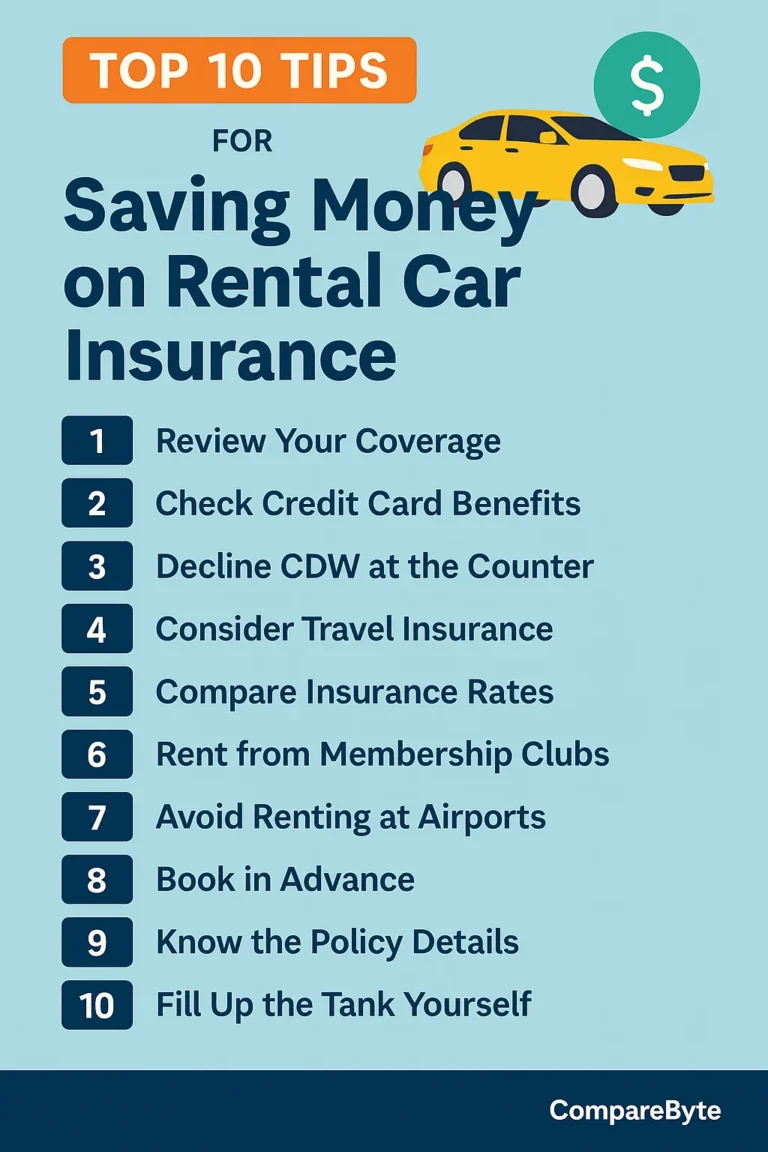

H4: Not Comparing Policies

Failing to compare different providers can lead to paying hundreds more annually. Always use online comparison tools to weigh your options.

H4: Ignoring State Requirements

Each state has different reinstatement rules. Make sure your policy meets your state’s legal obligations.

H4: Allowing Coverage Gaps

Even if you’re not driving, a lapse in coverage raises red flags for future insurers and results in higher premiums.

Frequently Asked Questions (FAQ)

Can I get insurance with a suspended license?

Yes, though your options may be limited. Non-owner or SR-22 policies are often available depending on your state.

What is SR-22 insurance?

SR-22 is a certificate filed with your state to prove you carry the minimum required liability insurance.

Will my premium be higher with a suspended license?

Most likely, yes. Insurers view suspended licenses as an indicator of risk, leading to higher premiums.

For related topics, check out our articles on Car Insurance category.