Having your driver’s license suspended is a stressful situation, and it often brings additional complications—especially when it comes to car insurance. Whether your license was suspended due to unpaid tickets, DUI, or other infractions, getting back on the road legally means finding the right insurance policy, and that can be tricky.

This guide will walk you through the best methods for obtaining insurance with a suspended license. We’ll cover what it means, how to approach insurers, common pitfalls to avoid, and real comparisons that help you make informed decisions. Let’s dive in and take the complexity out of this important process.

Understanding Insurance for a Suspended License

A suspended license essentially means your driving privileges have been temporarily withdrawn. During this time, you are legally not allowed to drive, but in many cases, you’ll still need to maintain or obtain auto insurance, especially if you plan to reinstate your license later. Some states even require proof of insurance as part of the reinstatement process.

One of the most common requirements in such cases is obtaining an SR-22 certificate. This isn’t a type of insurance but rather a form your insurer files with the state, proving you have the required coverage. This is often mandated after serious violations like DUI, reckless driving, or repeat offenses.

Insurance for drivers with a suspended license is categorized as “high-risk auto insurance.” Premiums can be significantly higher, and not all insurers are willing to cover such drivers. However, understanding the system and how to present yourself can lead to more favorable options.

It’s also important to understand that your vehicle still needs to be insured if it’s being financed or parked in public areas, regardless of your driving status. Lapses in coverage can further complicate your record and increase your premiums in the future.

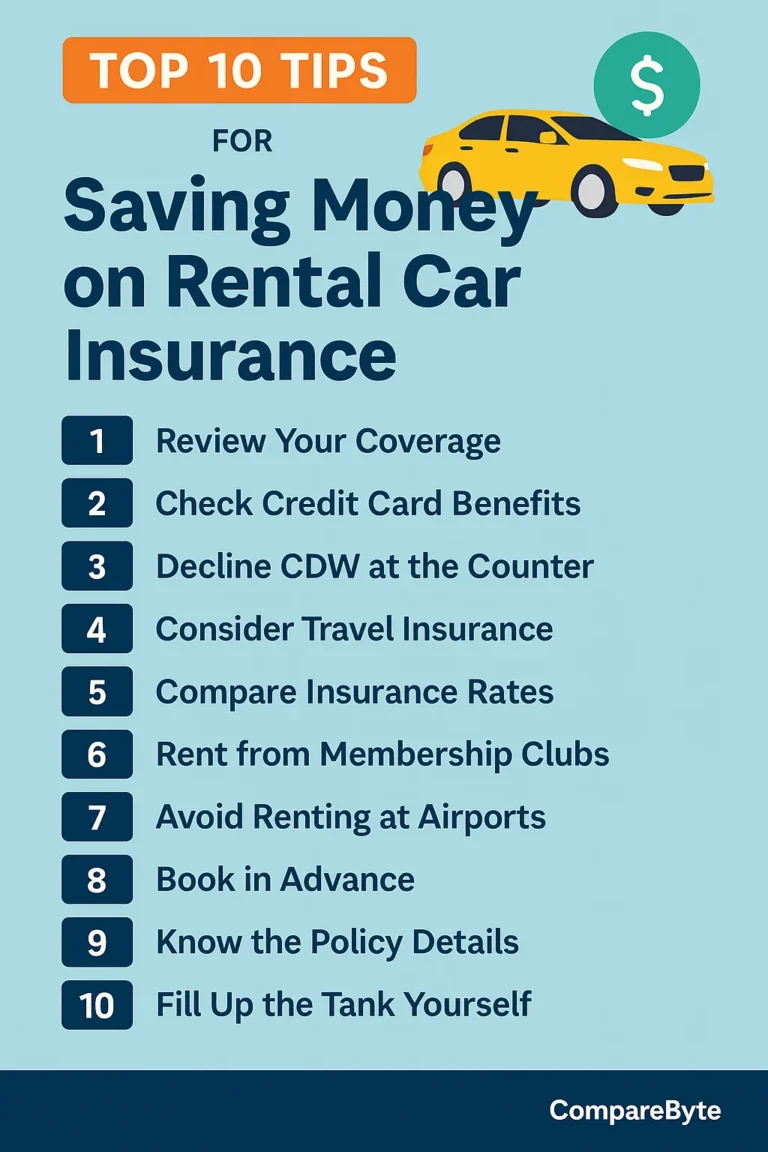

Top 7 Ways to Find Insurance with a Suspended License

1. Look for Insurers Specializing in High-Risk Drivers

Companies like The General, Dairyland, and National General offer policies tailored to high-risk individuals. They’re more likely to work with drivers holding a suspended license and may even assist with SR-22 filings.

2. Request SR-22 Filings from Your Current Insurer

If your policy was canceled, ask your previous insurer if they offer SR-22 filing services. Some companies may allow you to reinstate your policy without starting from scratch.

3. Shop Around Online

Use comparison tools to find the most competitive rates for SR-22 insurance. Some platforms cater specifically to high-risk drivers and can provide quotes within minutes.

4. Maintain or Reduce Your Coverage Type

If you don’t plan on driving during your suspension, consider a non-owner policy. These are cheaper and can fulfill your legal requirements for reinstatement without covering a specific vehicle.

5. Work with Independent Insurance Agents

Independent agents have access to multiple carriers and can match you with one that fits your risk profile. This is especially helpful if you’ve been denied coverage elsewhere.

6. Avoid Gaps in Coverage

Even with a suspended license, maintaining continuous coverage is crucial. Insurance lapses can lead to even higher premiums and longer reinstatement delays.

7. Improve Your Driving Record

Enroll in defensive driving courses, pay off fines, and avoid further infractions. A better record makes you less risky and more attractive to insurers over time.

Common Mistakes to Avoid and How to Fix Them

❌ Not Disclosing Suspension to Insurers

Some drivers attempt to hide their suspension. Insurers will find out anyway through motor vehicle records, which may lead to policy cancellations or fraud flags.

✅ Be Transparent

Always disclose your suspension status. Honest applicants often get better results when agents know the full picture.

❌ Letting Insurance Lapse

A lapse during a suspension might make it harder to reinstate your license and could trigger additional state penalties.

✅ Keep Non-Owner Coverage Active

If you’re not driving, opt for non-owner insurance to stay compliant with minimum requirements.

❌ Choosing the First Policy You See

Prices vary widely between providers. Not comparing rates could mean overpaying hundreds of dollars annually.

✅ Use Comparison Platforms

Take advantage of online quote tools and independent agents to ensure you’re getting the best deal possible.

Comparison Tables

| Provider | SR-22 Filing Fee | Monthly Premium (Avg.) | States Covered |

|---|---|---|---|

| The General | $25 | $120 | All 50 |

| Dairyland | $15 | $105 | 47 States |

| National General | $20 | $110 | 48 States |

| Coverage Type | Recommended For | Cost Range |

|---|---|---|

| Full Coverage | Drivers planning to reinstate soon | $150–$300/month |

| Liability Only | Required for SR-22 minimums | $80–$150/month |

| Non-Owner Policy | Those not driving but needing SR-22 | $40–$70/month |

Frequently Asked Questions

Can I get insurance with a suspended license?

Yes, though not all insurers offer it. You’ll likely need an SR-22 filing and should work with high-risk providers or independent agents.

What is an SR-22 form?

An SR-22 is a document that proves you carry the required insurance coverage. It’s filed with your state by your insurer and is often required after serious driving offenses.

How long do I need to maintain SR-22 insurance?

Most states require SR-22 coverage for 2–3 years. The exact duration depends on the nature of the violation and your state laws. Read more here.

Conclusion and Call to Action

Finding insurance with a suspended license can feel overwhelming, but with the right information and resources, you can regain control of your driving future. From choosing the right provider to maintaining necessary forms like SR-22, your path forward is clearer than you might think.

If you’re currently in this situation, start by comparing quotes from high-risk insurance specialists and talk to a licensed agent who understands the process. The sooner you act, the sooner you can begin the process of reinstatement—and peace of mind.

Ready to compare your options? Use our Suspended License Insurance Finder Tool and take the first step toward legal driving today.