For many college students, renting off-campus housing is a major step toward independence. However, with that independence comes a range of responsibilities—especially when it comes to protecting your personal belongings and liability in a shared living space. That’s where insurance for rented campus housing becomes essential.

From understanding what’s covered to choosing the right policy, navigating campus housing insurance can be confusing. This comprehensive guide breaks it down step by step, combining expert advice and practical insights to help students and parents make informed decisions.

Understanding Insurance for Rented Campus Housing

Insurance for rented campus housing—also known as renters’ insurance or student tenant insurance—is designed to protect students living in off-campus accommodations. While your school might have insurance for dormitories, that coverage often doesn’t extend to rented houses or apartments.

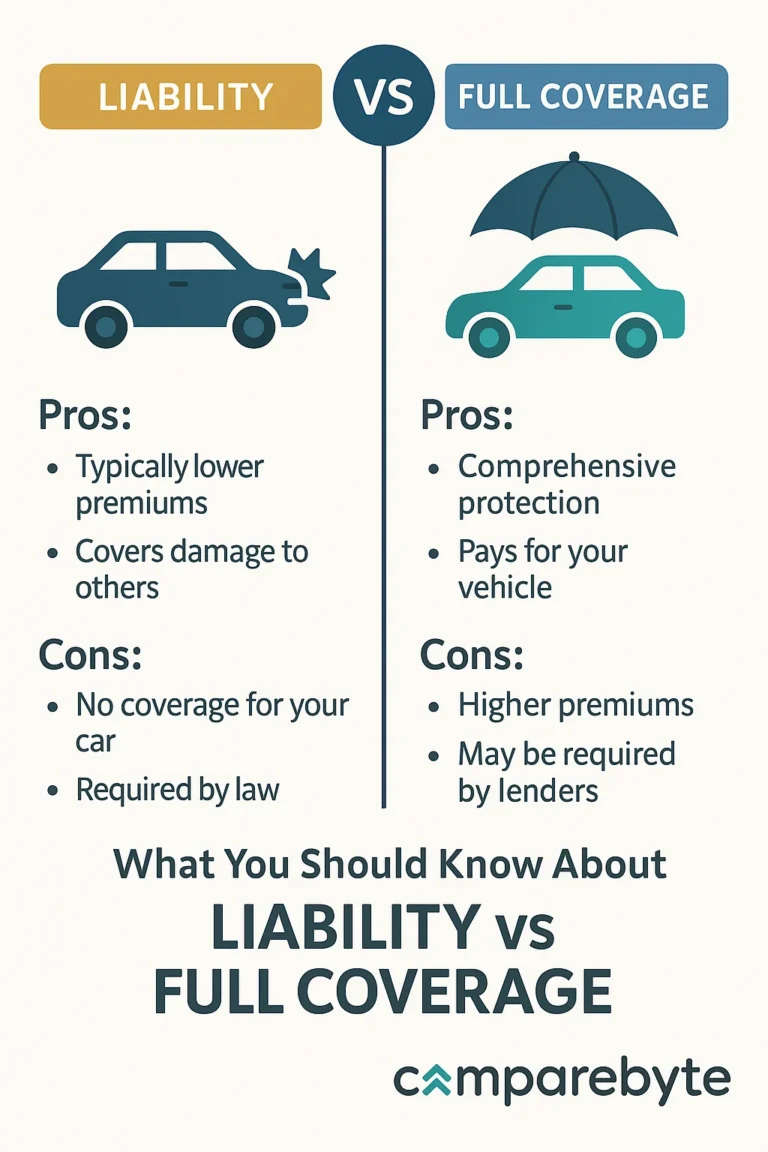

This type of policy typically covers two major areas: personal property (like laptops, clothes, and furniture) and liability protection (for example, if someone gets injured at your rental). Depending on the provider, it may also include additional living expenses if you’re temporarily displaced.

While some landlords may require tenants to have insurance, even when it’s not mandatory, securing a policy is a wise financial decision. Students are particularly vulnerable to risks like theft, fire, and water damage—especially in shared living spaces.

Costs are surprisingly low. According to the National Association of Insurance Commissioners (NAIC), the average renters’ insurance policy costs between $15 and $30 per month in the U.S., depending on the coverage amount and location.

Top Things to Know: A Student’s Checklist

1. Know What’s Covered

Your policy should cover personal belongings both inside and outside the residence. Make sure items like electronics, textbooks, and bicycles are included. Some providers also protect against identity theft.

2. Liability Coverage Is Crucial

If someone slips and falls during a party you host, you could be liable. A good renters’ policy includes liability protection and even medical payments to others in case of accidents.

3. Roommates Aren’t Automatically Covered

Unless they’re a spouse or relative, roommates usually need separate policies. Sharing a policy can be risky since claim payments may not be distributed fairly, and disputes can arise.

4. Off-Premises Coverage

Some policies provide off-premises coverage, which protects your property when it’s outside the rental unit—like a laptop stolen at the library.

5. Check the Deductibles

Deductibles are the amount you pay before your insurance kicks in. Make sure your deductible isn’t too high compared to the value of your belongings.

6. Landlord Insurance Doesn’t Cover You

Many students wrongly assume their landlord’s insurance covers their personal belongings. In most cases, landlord policies only cover the building—not the tenant’s possessions.

7. Discounts Are Available

Students may qualify for discounts if they have good grades, bundle with auto insurance, or install safety features like smoke detectors. Ask providers for student-specific offers.

8. Temporary Living Expenses

If a fire or flood displaces you, some policies cover additional living expenses such as hotel stays or meals. This is particularly helpful during finals or midterms.

9. Compare Policy Types

Actual Cash Value (ACV) reimburses for the depreciated value of belongings, while Replacement Cost Coverage (RCC) pays to replace them with new items. RCC policies usually cost more but offer better value.

10. International Students Need Special Considerations

Some insurers offer tailored plans for international students, which may include multilingual support and global asset protection. Make sure you review visa requirements and university policies.

Common Mistakes Students Make—and How to Avoid Them

❌ Assuming Parental Home Insurance Covers You

Many students believe their parents’ homeowner policy extends to campus housing. In most cases, this only applies to on-campus dorms and not rented apartments. Confirm with the insurer.

❌ Forgetting to Document Belongings

Not having an inventory can delay or even nullify a claim. Always take photos or videos of valuables and keep digital receipts.

❌ Choosing the Cheapest Policy Without Reading Terms

A lower premium might mean poor coverage. Carefully read policy limits, exclusions, and deductible terms before committing.

✅ Proactive Tip: Use Comparison Tools

Sites like PolicyGenius and NerdWallet allow students to compare policies tailored to college housing needs.

✅ Proactive Tip: Combine Coverage

Combining renters insurance with auto or health insurance may reduce total costs. Providers like State Farm and Progressive offer bundle discounts.

Comparative Tables for Quick Insights

| Coverage Type | Description | Average Limit |

|---|---|---|

| Personal Property | Protects items like clothes, electronics, books | $10,000 – $30,000 |

| Liability | Protection if you’re legally responsible for damage or injury | $100,000 – $300,000 |

| Additional Living Expenses | Reimburses hotel stays, meals during displacement | $1,000 – $5,000 |

| Provider | Monthly Premium | Student Discounts | Off-Campus Coverage |

|---|---|---|---|

| Lemonade | $12 | Yes | Yes |

| State Farm | $15 | Yes (GPA) | Yes |

| Allstate | $17 | Bundle Discount | Yes |

Frequently Asked Questions (FAQ)

Do I need renters insurance if I live off-campus?

Yes. Landlords typically do not cover your personal items or liability. Renters insurance ensures financial protection.

Can international students get coverage?

Absolutely. Many companies now offer plans tailored to international students, including support in multiple languages.

Is renters insurance mandatory for student housing?

It depends on the landlord and university policy. Some require it as part of the lease agreement. Always confirm before signing.

Conclusion & Call to Action

Insurance for rented campus housing isn’t just an optional expense—it’s a smart investment in peace of mind. From safeguarding your valuables to protecting against legal liabilities, the right policy can make a world of difference during your academic journey.

Before you sign your next lease, take a few minutes to compare providers, understand your coverage, and ask the right questions. You’ll thank yourself later if the unexpected happens.

Still unsure where to start? Visit our guides on Best Student Insurance Plans and How to Compare Renters Insurance Policies for additional insights and provider comparisons tailored to students.