When it comes to buying insurance, how you choose to pay can make a big difference in the long run. For many people, paying monthly is convenient, but opting for annual premiums could offer more savings and fewer headaches.

This beginner-friendly guide explains the advantages and disadvantages of annual insurance payments in simple terms. Whether you’re new to insurance or trying to decide on the best payment schedule, we’ll break it all down for you step by step.

What Are Annual Premiums and How Do They Work?

In insurance terms, a “premium” is the amount you pay to keep your policy active. While monthly payments break this down into 12 smaller amounts, annual premiums require you to pay the entire year’s cost upfront in one lump sum.

For example, if your auto insurance costs $1,200 per year, you can either pay $100 per month or the full $1,200 all at once. Many insurers offer a slight discount for the annual option because it reduces their processing costs and ensures they get paid in full.

Annual premiums are common across all types of insurance—health, auto, home, renters, and even travel policies. They are especially favored by people who want to set and forget their insurance for the year without worrying about monthly bills.

However, paying annually also means you must be financially prepared to spend a larger amount at one time. This can be challenging for people living paycheck to paycheck or managing multiple monthly expenses.

Still, understanding how annual payments fit into your personal budget can help you make smarter financial choices about insurance.

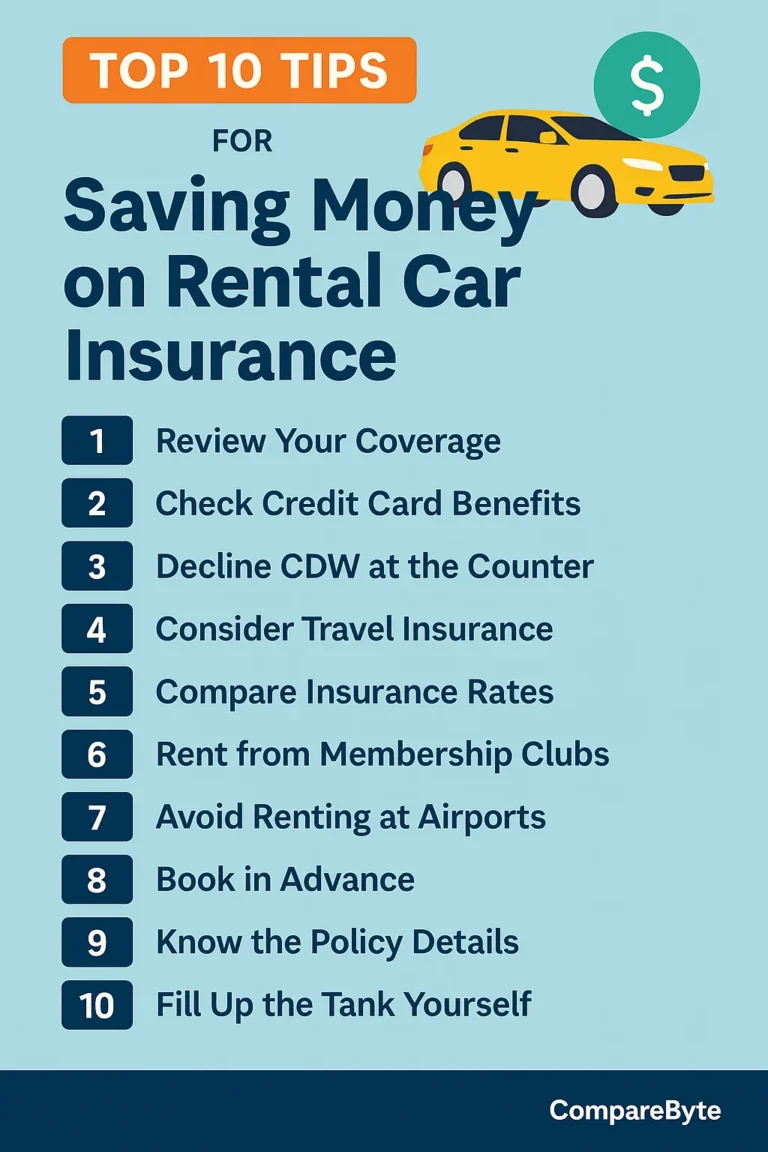

Step-by-Step: How to Decide If Annual Premiums Are Right for You

1. Review Your Budget

Start by checking if you can afford to pay the full yearly premium upfront. Make sure it won’t cause financial strain or disrupt other necessary expenses.

2. Compare Costs

Ask your insurer how much you’d pay monthly versus annually. Calculate the total cost in both scenarios and look for any hidden fees in monthly plans.

3. Evaluate Discounts

Many companies offer a discount of 5–10% for choosing an annual plan. These savings add up over time, especially for auto or home insurance.

4. Consider Convenience

If you prefer fewer bills or don’t want to worry about missed payments, annual premiums simplify things with just one payment per year.

5. Ask About Refund Policies

Find out if you can get a refund if you cancel early. Some insurers may offer prorated refunds, while others have strict non-refundable clauses.

Comparison Table: Monthly vs Annual Premiums

| Feature | Monthly Premium | Annual Premium |

|---|---|---|

| Payment Frequency | 12 times a year | Once per year |

| Total Yearly Cost | $1,260 (with fees) | $1,200 (no fees) |

| Convenience | Regular reminders | One-time setup |

| Risk of Cancellation | Higher if missed payments | Lower after upfront payment |

Real Examples: When Annual Premiums Make Sense

| Scenario | Recommended Plan | Reason |

|---|---|---|

| Young driver, tight budget | Monthly | Better cash flow control |

| Homeowner with stable income | Annual | Saves money and hassle |

| Frequent traveler | Annual | Less risk of missing payments abroad |

Final Thoughts and What to Do Next

Choosing between monthly and annual payments is more than just a matter of preference—it can impact your overall budget and insurance experience. Annual premiums can help you save money, avoid fees, and simplify your life, but only if you’re financially ready.

Now that you know the key differences and when each option makes sense, talk to your insurance provider or explore quotes online. Ask for total cost comparisons and look for top insurance providers that offer annual discounts.

Want to explore more about saving on insurance? Read our guides:

How to Choose the Right Deductible and

Understanding Bundled Insurance Discounts.

Take control of your insurance finances today. Evaluate your plan, ask the right questions, and start saving smarter with the right premium strategy!