Living on or near campus is a quintessential part of the college experience. However, many students and their families overlook a crucial factor—insurance for rented campus housing. A theft, fire, or accident could lead to significant out-of-pocket costs without proper coverage.

This guide unpacks smart and practical strategies to ensure your belongings and liability are covered while living in a rented dorm or apartment near campus. We’ll explore policy types, top provider comparisons, common pitfalls, and FAQs to help you make informed decisions that protect both your finances and peace of mind.

Understanding Insurance for Rented Campus Housing

Rented campus housing insurance refers to coverage designed for students living in college dorms or nearby rental properties. These plans generally protect personal belongings, offer liability coverage, and sometimes additional living expenses in case of temporary displacement due to damage or disaster.

Unlike homeowners insurance, these policies are tailored for renters, and often come in the form of renters insurance. Some providers offer specialized student renters insurance with lower premiums and coverage limits suited to campus life.

Coverage can include protection against theft, fire, vandalism, water damage (not flooding), and liability if someone is injured in your residence. It’s crucial to read the fine print, as some policies exclude roommate possessions or damage from natural disasters like earthquakes or floods.

Whether you live in on-campus housing or off-campus apartments, understanding your rights, risks, and responsibilities is essential. Universities typically don’t cover your personal property through their own insurance plans.

Top 10 Smart Strategies for Insurance in Rented Campus Housing

1. Assess Your Current Coverage

Some students may already be covered under their parents’ homeowners insurance. However, the coverage might be limited or have high deductibles. Verify the policy terms, especially if you’re more than 100 miles from your permanent residence.

2. Compare Student-Focused Renters Insurance Providers

Companies like Lemonade, Allstate, and State Farm offer affordable plans tailored to students. Use comparison tools or speak to an advisor to get the best rates with suitable limits.

3. Inventory Your Belongings

Document all valuables such as laptops, electronics, textbooks, and bicycles. Use digital apps or spreadsheets to create a detailed inventory, including receipts and photos, to streamline claims.

4. Choose Appropriate Coverage Limits

Opt for a policy with sufficient limits to replace your belongings. While a $10,000 limit might sound adequate, high-value electronics and study tools can easily exceed that. Don’t forget liability coverage in case someone is injured in your apartment.

5. Understand the Deductibles

Policies come with deductibles—amounts you pay before insurance kicks in. A lower deductible means less upfront cost during a claim, but a slightly higher premium. Choose based on your financial flexibility.

6. Ask About Roommate Coverage

Most policies don’t cover roommates unless explicitly added. Encourage roommates to get separate coverage to avoid conflicts and gaps in protection.

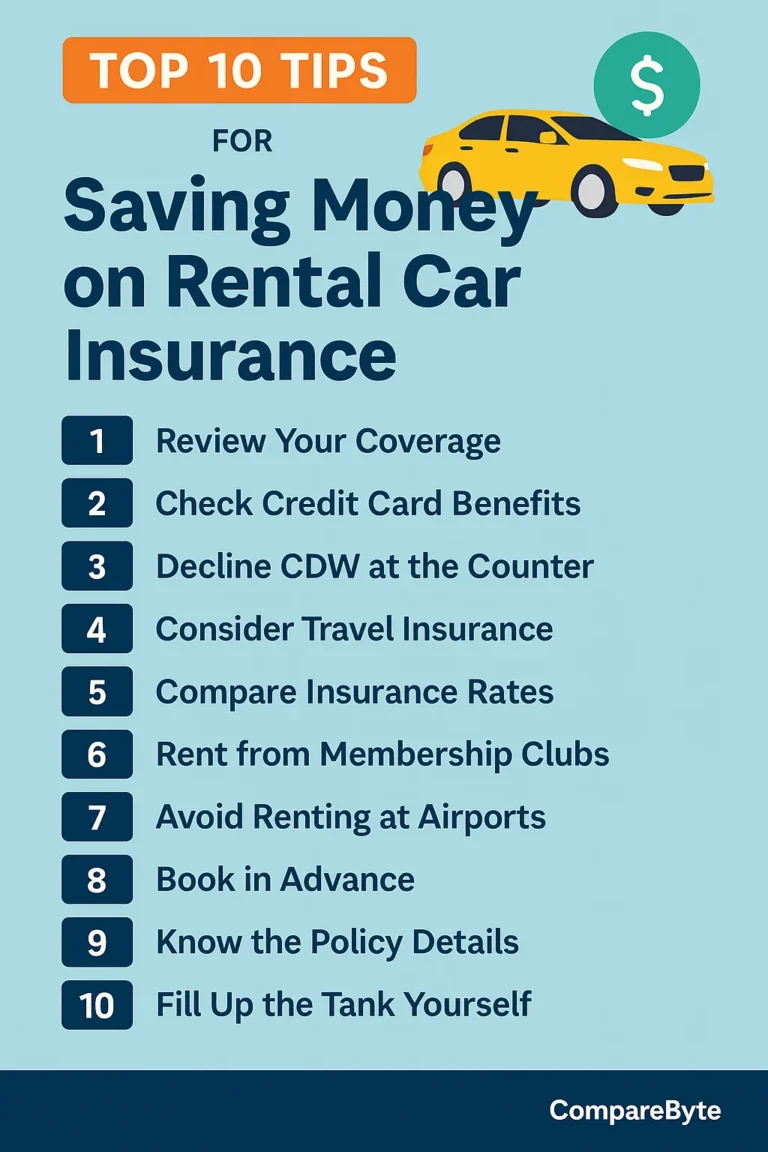

7. Look for Bundling Options

If you own a car or plan to purchase one, check whether your insurer offers bundling discounts with student car insurance. This can reduce overall costs significantly.

8. Protect Against Identity Theft

Some renters insurance policies offer add-ons for identity theft protection. Given the high volume of digital data in college environments, this feature can provide extra security.

9. Consider Replacement Cost vs. Actual Cash Value

Choose a policy that reimburses you based on the replacement cost rather than depreciated value. While it might cost more, it ensures you can buy a new laptop, not a used one.

10. Review Your Lease Agreement

Some landlords require renters insurance. Others may offer a liability-only policy bundled with rent. Understanding your lease obligations avoids duplicate payments or gaps.

Common Mistakes and How to Avoid Them

Underestimating Property Value

Students often think they don’t own enough to warrant coverage. But phones, laptops, instruments, and clothing quickly add up. Perform a full inventory and calculate replacement costs.

Skipping Policy Reviews

Failing to update or re-evaluate your insurance annually may leave you underinsured, especially after upgrading devices or moving residences.

Not Reading Exclusions

Every policy has exclusions—some don’t cover floods, others exclude damages caused by roommates. Reading these carefully is vital for understanding what risks you’re still exposed to.

Assuming Landlord Coverage

Landlords insure the structure, not your belongings. Students often assume otherwise and discover too late that personal property isn’t covered after a loss.

Comparison Tables

| Provider | Monthly Cost | Coverage Limit | Identity Theft | Bundling Available |

|---|---|---|---|---|

| Lemonade | $5 | $10,000+ | Yes | Yes |

| State Farm | $7 | $15,000+ | No | Yes |

| Allstate | $10 | $20,000+ | Yes | Yes |

| Feature | Replacement Cost | Actual Cash Value |

|---|---|---|

| Premium | Higher | Lower |

| Payout | New Item Value | Depreciated Value |

| Best For | Electronics, Essentials | Budget-Conscious Students |

Frequently Asked Questions

Is renters insurance mandatory for campus housing?

Not always, but many universities or landlords now require it. Always check your housing agreement.

Will renters insurance cover my roommate’s items?

No, unless they’re named on the policy. It’s best for each roommate to have their own policy.

Does renters insurance cover items stolen from my car?

Yes, in most cases, but not the car itself. Check policy details for off-premises coverage limits.

Conclusion and Call to Action

Choosing the right insurance for rented campus housing protects your finances, technology, and peace of mind throughout your academic journey. From smart comparisons and inventory prep to avoiding mistakes, a well-chosen policy is a powerful safeguard.

Don’t wait until it’s too late. Assess your risks, compare providers, and get the protection you need today. For more on affordable student car insurance or deductible comparison strategies, explore our other expert guides.