Finding affordable car insurance as a student in Texas can feel impossible. With limited driving experience, tight budgets, and often no credit history, most insurers charge high premiums. But don’t worry — this guide reveals the best and cheapest car insurance options specifically tailored for college students in Texas. Whether you’re commuting to campus or planning a road trip, we’ve got you covered.

Why Is Car Insurance So Expensive for Students in Texas?

Student drivers in Texas often face higher car insurance premiums due to several factors: limited driving experience, younger age (typically under 25), and lack of credit history. Insurance companies classify these drivers as “high risk,” which increases rates significantly. Additionally, urban areas like Houston, Austin, and Dallas have higher accident and theft rates, further inflating costs.

Top 7 Cheapest Insurance Providers for Texas Students (2025)

1. GEICO

GEICO offers some of the most competitive student discounts in Texas, especially for drivers with a GPA of 3.0 or higher. Their “Good Student Discount” and “Defensive Driving Course Discount” can significantly lower your premiums. Monthly student rates can start around $70–$90. Their mobile app and claim process are also top-notch.

2. Progressive

Progressive is ideal for college students thanks to their “Snapshot” usage-based insurance program, which rewards safe driving habits. They offer customizable coverage, student discounts, and flexible payment plans. Many Texas students report saving up to 20% after enrolling in Snapshot.

3. State Farm

With a strong presence in Texas, State Farm provides several discount opportunities for students — including the Steer Clear® program and good student discounts. They are known for strong local agents and reliable customer service, making them a favorite among young drivers.

4. Esurance

Owned by Allstate, Esurance provides digital-first insurance tailored for tech-savvy students. They offer affordable base plans with options to add coverage as needed. While their discounts for students aren’t as extensive, their rates are often lower due to lean online operations.

5. Root Insurance

Root sets itself apart by using a smartphone app to track your driving habits before offering a quote. If you’re a safe student driver, you can save big. Root avoids stereotypes and instead prices based on actual performance — making it fairer for young drivers.

6. Liberty Mutual

Liberty Mutual offers competitive rates for student drivers and allows bundling with renters insurance — which is perfect for students living off-campus. Their “RightTrack” program offers up to 30% off for safe driving and they often run regional promotions in major Texas cities.

7. USAA (for Military Students)

If you or your parents are affiliated with the military, USAA is one of the best insurance options available. They offer exclusive rates, unbeatable customer service, and superior coverage. For eligible students in Texas, USAA rates are typically among the lowest in the market.

Student Discounts You Should Know About

Most major insurance companies offer specific discounts tailored for students — but many students don’t even know they exist. If you’re in Texas and looking to save on your monthly premium, check out these discounts you might already qualify for.

1. Good Student Discount

If you maintain a GPA of 3.0 or higher (B average), many insurers — including GEICO, State Farm, and Progressive — offer discounts ranging from 10% to 25%. All you need is your latest transcript or report card as proof.

2. Defensive Driving Course

Completing a state-approved defensive driving course can get you a discount on your policy. In Texas, this is often one of the quickest ways for student drivers to lower their rates — especially with Progressive and Liberty Mutual.

3. Stay on a Parent’s Policy

Remaining on your parents’ car insurance policy can significantly reduce your costs. Insurers consider multi-driver policies as lower risk and offer better rates than individual student plans. Most carriers allow students under 25 to stay on a parent’s policy if they live at home or attend school full-time.

4. Away at School Discount

If your college is more than 100 miles from home and you’re not taking a car, you might be eligible for a discount since the risk of accidents is much lower. GEICO and State Farm both offer this for out-of-town students.

5. Low Mileage Discount

If you drive very little — under 7,500 miles per year — you can qualify for a low mileage discount. This is perfect for students who only use their car occasionally or for short commutes. Usage-based programs like Root and Snapshot (Progressive) work great here.

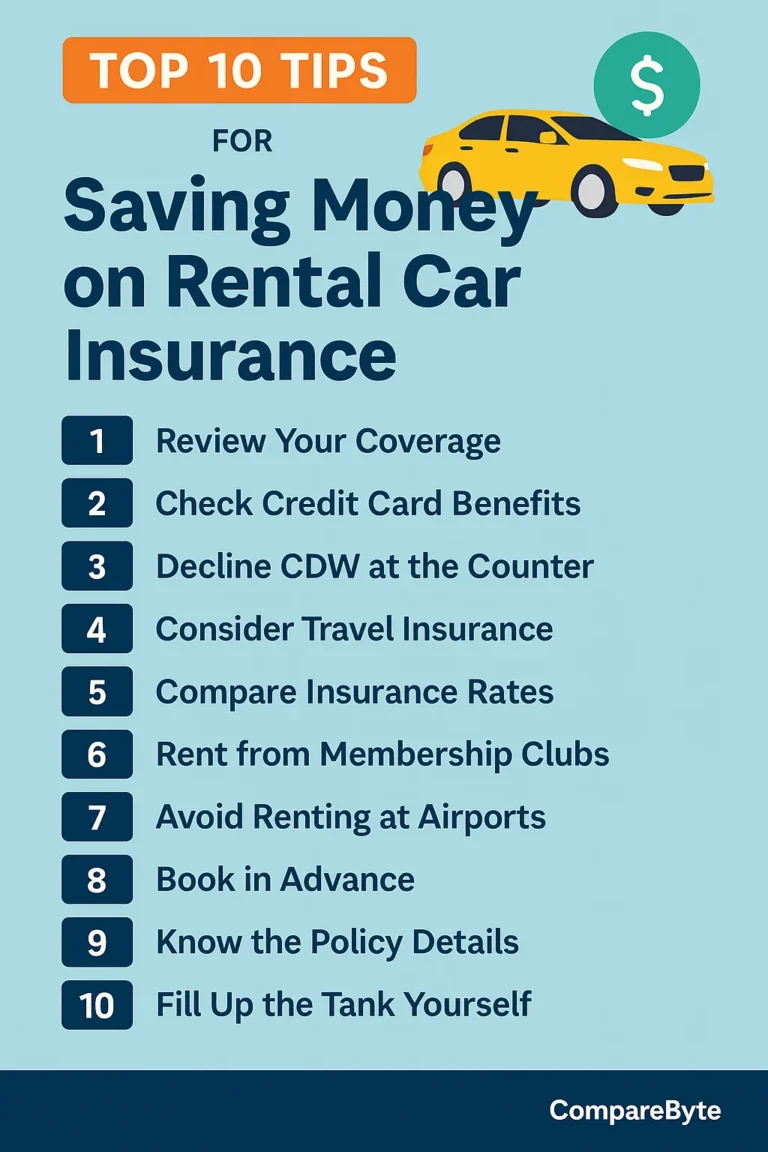

Tips to Lower Your Premium as a Student Driver

Even if you don’t qualify for every discount, there are still several smart strategies you can use to lower your car insurance costs as a student in Texas. Here are the most effective ones:

1. Compare Quotes Before You Buy

Never go with the first quote you get. Use comparison tools (like ours 😉) to check rates from multiple providers. Prices can vary by hundreds of dollars for the same coverage, depending on your ZIP code, driving history, and vehicle type.

2. Choose a Higher Deductible

Opting for a higher deductible (like $1,000 instead of $500) can reduce your monthly premium. Just make sure you have enough saved to cover it in case of an accident.

3. Drive a Safe, Affordable Car

Avoid flashy sports cars. Insurance companies reward safe vehicles with good safety ratings and lower theft risk. Driving a reliable sedan or compact car could save you big time.

4. Maintain a Clean Driving Record

Tickets, accidents, and even small claims can skyrocket your rates. Drive carefully, avoid speeding, and stay off your phone. Usage-based programs like GEICO DriveEasy or Progressive Snapshot can even reward your good behavior.

5. Bundle Your Insurance Policies

If you’re renting an apartment or have other insurance needs, bundling your policies (car + renters insurance) with the same provider — like Liberty Mutual or State Farm — can get you multi-policy discounts.

Frequently Asked Questions (FAQs)

What’s the cheapest car insurance for students in Texas?

GEICO, Progressive, and State Farm often offer the most affordable plans for students, especially when combined with good student discounts and usage-based programs.

Can I stay on my parents’ car insurance if I’m in college?

Yes, most insurance providers allow students under 25 to stay on their parents’ policy if they are full-time students and/or living at home. This can lead to major savings.

Do student drivers get discounts in Texas?

Yes. Many insurers offer discounts for good grades, safe driving, low mileage, and even completing defensive driving courses. Always ask your provider what’s available.

Does credit score affect car insurance for students?

In Texas, yes. Insurance companies often consider credit history when calculating premiums. Students with little or no credit history may face higher rates, but usage-based programs can help offset that.

Compare and Save Today

Car insurance doesn’t have to drain your student budget. By choosing the right provider, applying for available discounts, and following smart driving habits, you can cut costs without sacrificing coverage. The best part? You don’t need to do it alone.

At CompareByte Insurance, we make it easy for students to compare rates, understand their options, and find the best coverage for their unique situation. Start by checking out quotes from the providers listed above — and take the first step toward smarter savings.