Understanding how car insurance in Florida works can be a bit tricky for beginners. Florida has some of the most unique and complex insurance laws in the United States, especially due to its no-fault system and the high number of uninsured drivers. Whether you’re a resident or planning to move, it’s crucial to understand how policies, coverage, and legal requirements interact in the Sunshine State.

This guide breaks down everything you need to know about Florida car insurance in simple terms. We’ll compare key coverage types, advantages and disadvantages, and real-world scenarios to help you make informed decisions and avoid costly mistakes.

Overview of Florida Car Insurance Types

Personal Injury Protection (PIP)

Florida mandates all drivers to carry a minimum of $10,000 in Personal Injury Protection (PIP). This is a core part of the state’s no-fault insurance law, which means your insurance pays for your medical expenses regardless of who was at fault.

PIP covers 80% of necessary medical bills and 60% of lost wages after an accident. However, it does not cover vehicle damages or pain and suffering. This type of coverage is intended to reduce lawsuits and expedite medical payment processing.

One downside is that the coverage limit of $10,000 can be exhausted quickly in serious accidents. Moreover, it doesn’t cover passengers unless they are related to you or live in the same household.

It’s worth noting that PIP benefits are only available if you seek medical care within 14 days of the accident — a requirement that many overlook.

Property Damage Liability (PDL)

Florida law also requires a minimum of $10,000 in Property Damage Liability (PDL) coverage. This pays for damage you cause to another person’s vehicle or property. It does not, however, cover damages to your own vehicle.

PDL is essential for complying with state law but often insufficient in high-value accident cases. Many drivers choose to increase their coverage limits beyond the minimum requirement.

Unlike other states, Florida does not require Bodily Injury Liability (BIL) unless the driver has been involved in specific violations, like a DUI.

While optional, BIL is highly recommended to protect your personal assets in the event of a serious accident, especially since medical lawsuits in Florida can lead to substantial financial liabilities.

Advantages and Disadvantages of Florida Car Insurance Types

| Coverage Type | Advantages | Disadvantages |

|---|---|---|

| PIP (Personal Injury Protection) |

– Pays medical bills regardless of fault – Fast claims processing – Reduces legal disputes |

– Limited to $10,000 – Doesn’t cover vehicle damage – Must be used within 14 days |

| PDL (Property Damage Liability) |

– Mandatory by law – Protects you against property damage claims – Affordable minimum coverage |

– Doesn’t cover your own vehicle – Minimum coverage may be insufficient – No protection for medical liability |

| Optional Coverage | Pros | Cons |

|---|---|---|

| Bodily Injury Liability | Protects personal assets, covers lawsuits, widely accepted | Increases premium, not required by law |

| Comprehensive & Collision | Covers vehicle damage, theft, weather-related losses | Higher deductibles, not required by state |

Which Type of Coverage Is Best for Different Scenarios?

Scenario 1: You drive an older vehicle

If your car is over 10 years old and not worth much, sticking with basic PIP and PDL coverage might be sufficient. Paying extra for comprehensive or collision may not be cost-effective, as repair costs could exceed your car’s value.

Scenario 2: You have a new or financed vehicle

For drivers with newer cars or leased/financed vehicles, adding comprehensive and collision coverage is essential. Lenders typically require full coverage, and repairing a new vehicle can be costly without proper insurance.

Scenario 3: You frequently drive in high-traffic areas

In cities like Miami or Tampa, accident rates are higher. Investing in uninsured/underinsured motorist coverage is a smart choice. Florida has one of the highest uninsured driver rates in the U.S. — nearly 20%.

Real-World User Scenarios and Testimonials

“After my car was rear-ended in Orlando, I was shocked at how fast my PIP kicked in. But it didn’t cover all my costs.” — Maria T., Orlando, FL

“I bought only the required coverage to save money, but when a tree crushed my car during a hurricane, I wished I had comprehensive insurance.” — Jamal R., Fort Lauderdale, FL

“My daughter was in a minor crash, and her PDL didn’t cover the full damages to the other car. We had to pay out of pocket.” — Rachel K., Jacksonville, FL

These examples underline the importance of carefully assessing your personal situation when choosing Florida auto insurance.

Conclusion and Final Recommendation

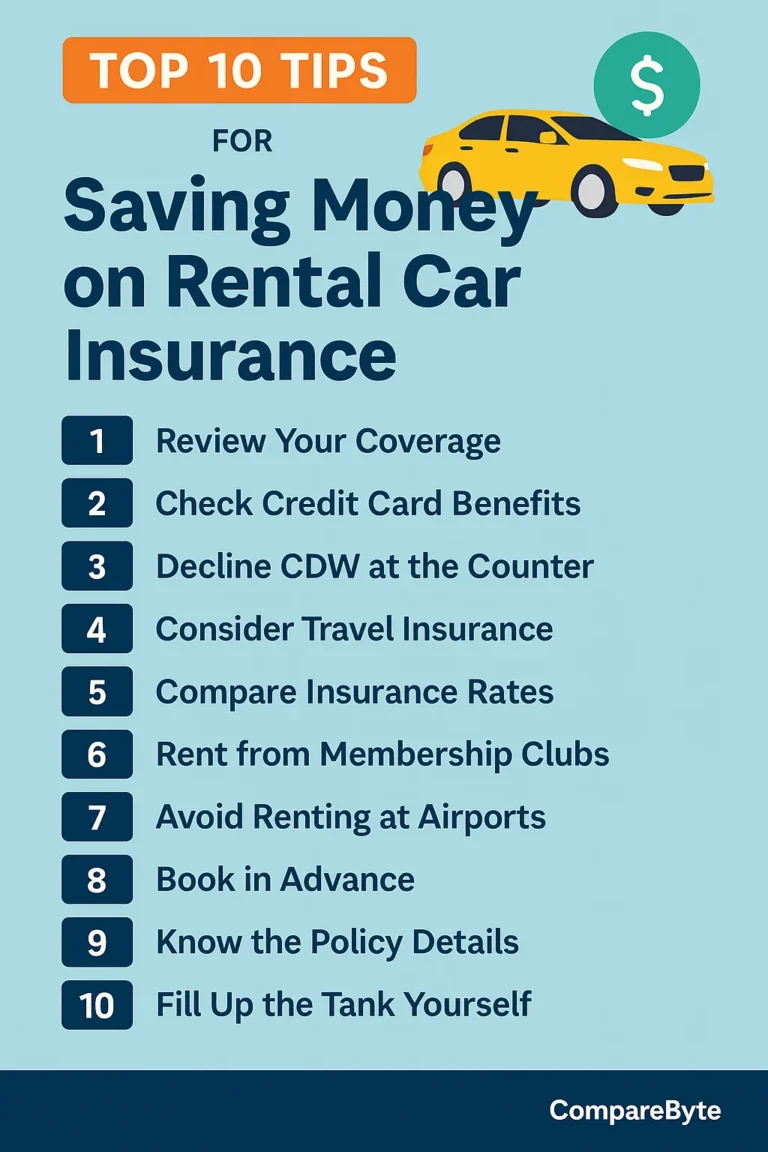

Car insurance in Florida is more than just meeting the state’s minimum requirements. While PIP and PDL provide a legal baseline, they offer limited protection in real-world scenarios. Consider your vehicle type, driving habits, and financial risk before finalizing your policy.

For most drivers, enhancing your coverage with Bodily Injury Liability, Comprehensive, and Uninsured Motorist Protection provides the best overall value and peace of mind. The best approach is to get multiple quotes from trusted insurers and compare their offerings based on your lifestyle and location.

Start by using Florida’s official insurance portal to understand your legal responsibilities, then check out comparison tools like Policygenius and The Zebra to find the right policy.

Helpful Internal Resources:

Take Action Now

Don’t wait until an accident happens. Get a free insurance quote today and ensure you’re covered for any situation Florida’s roads might throw your way.