When it comes to auto insurance, location matters more than most drivers realize. Factors such as traffic patterns, weather, accident rates, and even legal frameworks in your state can significantly influence your premiums. If you’re seeking to save money on your car insurance in 2025, understanding which states offer the most affordable options—and why—is essential.

This comprehensive guide will break down the best states for cheap auto insurance, explore the core reasons behind their affordability, and provide actionable strategies to help drivers in any state reduce their premiums. Whether you’re planning to relocate or simply want to assess your current rates, this article has you covered.

Understanding What Impacts Auto Insurance Rates

Auto insurance premiums are calculated based on a combination of personal and geographical risk factors. While your driving record and age play a role, the state you live in can often make the biggest difference.

H3: Geographic Risk Profiles

States with higher population density, urban congestion, and elevated accident rates generally experience higher premiums. For instance, rates in states like Michigan and Florida are substantially higher due to frequent claims and fraud rates.

H4: Regulation and Coverage Requirements

States with strict mandatory coverage requirements tend to have more expensive policies. No-fault insurance states, such as New York and New Jersey, often see higher costs due to the added complexity of claims processing.

H3: Climate and Natural Disasters

Weather patterns play a surprisingly large role. Hurricanes, hailstorms, and floods can all increase insurance claims, thus affecting the state’s average premiums.

Top 7 States with the Cheapest Auto Insurance

Data from NAIC and insurance aggregators like ValuePenguin reveal the most affordable states for auto insurance in 2025.

1. Maine

With its low population density and low accident rates, Maine consistently ranks among the states with the lowest premiums.

2. New Hampshire

New Hampshire stands out for not requiring liability insurance by law, reducing the overall cost for safe drivers.

3. Ohio

Competitive market conditions and moderate weather contribute to Ohio’s low insurance rates.

4. Idaho

Minimal congestion and a rural profile help keep rates low.

5. Wisconsin

Wisconsin’s combination of competition and low crime makes it affordable for most drivers.

6. Vermont

Like Maine, Vermont benefits from sparse traffic and low accident claims.

7. North Dakota

Low crash frequency and comprehensive public safety contribute to reduced insurance costs.

Comparison Table: Average Annual Premium by State

| State | Average Annual Premium | Required Coverage |

|---|---|---|

| Maine | $1,020 | Liability |

| New Hampshire | $1,050 | Optional |

| Ohio | $1,080 | Liability |

Best Strategies to Lower Your Auto Insurance Premium

H3: Bundle Insurance Policies

Combining home and auto insurance with the same provider can result in significant discounts of up to 25%.

H3: Maintain a Clean Driving Record

Insurance companies heavily reward drivers who avoid traffic tickets and accidents.

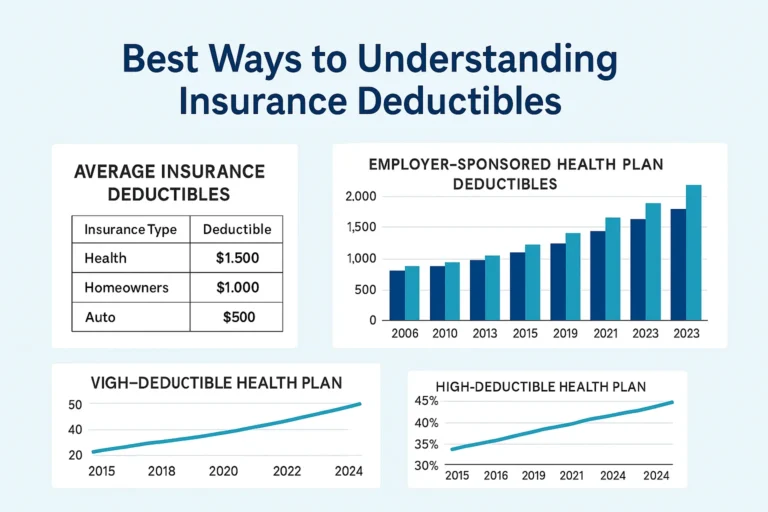

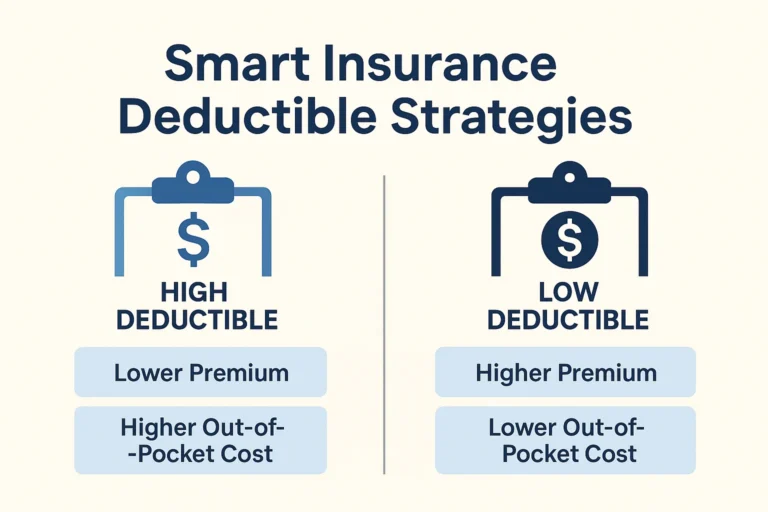

H3: Opt for a Higher Deductible

Choosing a higher deductible can lower your premium, especially if you’re a safe driver with minimal claims.

H3: Install Safety Features

Anti-theft devices, lane assist technology, and dash cams can reduce your premiums over time.

Risk Comparison Table: High-Cost vs Low-Cost States

| State | Average Premium | Primary Cost Factor |

|---|---|---|

| Florida | $2,580 | Weather and Fraud |

| Michigan | $3,200 | No-Fault System |

| Louisiana | $2,780 | Litigation and Claims |

Frequently Asked Questions

How can I check if my state has high insurance rates?

You can visit your state’s department of insurance or compare quotes through sites like The Zebra.

Does switching insurance providers really help save money?

Yes, regularly comparing providers can save hundreds annually. Rates change based on algorithms and regional risk factors.

What states should high-risk drivers avoid?

High-risk drivers may face steep premiums in states like Michigan, Florida, and Louisiana due to comprehensive legal and claim systems.

Conclusion and Summary

Understanding the best states for cheap auto insurance helps consumers make smarter decisions about where to live, how to budget, and how to shop for insurance. States like Maine, Ohio, and Idaho offer affordable options due to favorable local conditions, whereas states like Michigan or Florida come with higher costs due to regulatory or environmental issues.

To save on auto insurance, take proactive steps like bundling your policies, maintaining a clean record, and comparing quotes annually. Geography plays a key role—but with the right strategies, you can find affordable coverage anywhere.

Explore more insights with these related guides: Auto Insurance Comparison Guide and Smart Auto Insurance Strategies.