Getting your driver’s license suspended can feel like hitting a wall—but it doesn’t mean the end of your ability to secure car insurance. Whether your suspension was due to a DUI, too many tickets, or unpaid fines, there are still ways to find coverage. This guide explains the steps to take, common challenges, and how to navigate the process with confidence.

This article is written for complete beginners who are unsure where to begin. You’ll learn what insurance companies look for, what policies are available, and how to compare them to make the smartest decision.

Understanding Insurance with a Suspended License

A suspended license means your driving privileges are temporarily withdrawn. However, insurance is still necessary—especially if you’re planning to reinstate your license or own a vehicle. Insurers view drivers with suspended licenses as high-risk, which affects your insurance premiums and policy options.

The reasons for suspension vary: it could be from DUI/DWI offenses, driving without insurance, accumulating too many points on your license, or failing to pay child support. Regardless of the reason, you still have legal responsibilities tied to your vehicle ownership.

Some states even require you to file an SR-22 form, which is a certificate proving that you carry the minimum insurance required. This is often necessary before reinstating your license.

Insurers will also assess your driving history, current violations, and whether you’re actively trying to reinstate your license. Some may offer what’s called “parked car insurance” (comprehensive-only policies), while others may assist in filing SR-22s.

Understanding these insurance nuances can save you both time and money. Working with a specialized agent or insurer experienced in high-risk drivers is often the fastest way forward.

Step-by-Step: How to Get Insurance with a Suspended License

Step 1: Determine Why Your License Was Suspended

Understand the root cause of your suspension. This will influence whether you need an SR-22, the type of coverage you qualify for, and the waiting period involved.

Step 2: Know Your State Requirements

Each state has different rules. Visit your DMV’s official website to find out what’s required to get your license reinstated and what type of insurance you’ll need in the meantime.

Step 3: Get an SR-22 or FR-44 if Required

If your state mandates it, request an SR-22 or FR-44 from your insurance provider. Not all insurers offer this, so be upfront when requesting quotes.

Step 4: Shop Around for High-Risk Insurance Providers

Use comparison tools and brokers to get quotes from providers who specialize in high-risk or non-standard insurance. They often provide better terms and may help reduce your rates over time.

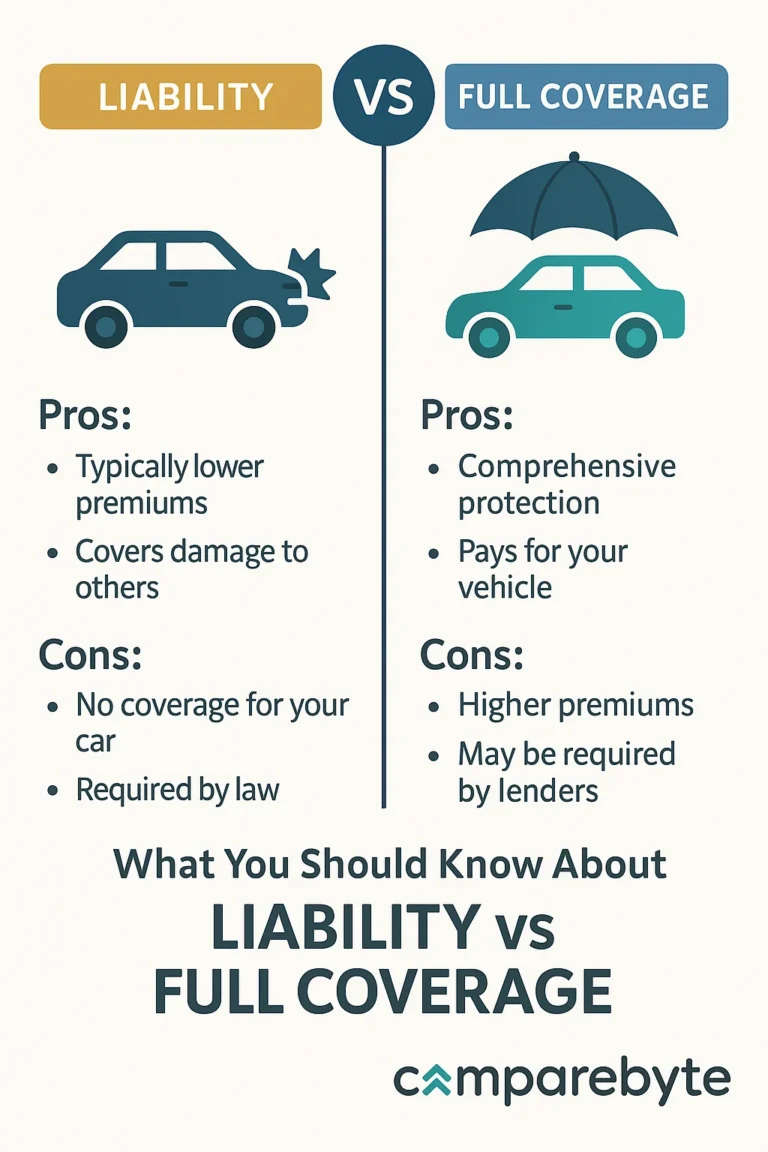

Step 5: Choose Between Coverage Options

Depending on whether you’re actively driving or not, you may need liability-only, full coverage, or comprehensive-only insurance (for non-driving coverage like theft or vandalism).

Step 6: Pay Premiums Upfront When Possible

Some insurers require upfront payment for high-risk policies. Paying in full may also get you discounts or fewer restrictions.

Step 7: Maintain Continuous Coverage

Even if you’re not driving, don’t let your policy lapse. Continuous coverage is a positive indicator for future policy applications and helps in lowering future premiums.

Insurance Options: Comparison Tables

| Type | Driving Allowed? | SR-22 Required? | Purpose |

|---|---|---|---|

| Non-Owner Car Insurance | No | Yes (Usually) | Maintain insurance without owning a car |

| Comprehensive-Only Insurance | No | No | Protects parked vehicles from theft, fire, etc. |

| Standard Auto Insurance | Yes | Depends on State | Required before license reinstatement |

| Provider | SR-22 Services | Best For | Website |

|---|---|---|---|

| Progressive | Yes | Online convenience | progressive.com |

| The General | Yes | High-risk profiles | thegeneral.com |

| GEICO | Some states | Quick reinstatement | geico.com |

Tips and Common Mistakes to Avoid

🛑 Waiting Too Long to Get Insurance

Every day you wait increases the risk of penalties and delays in reinstating your license.

🛑 Not Being Honest with Your Insurer

Omitting details about your suspension can lead to cancellations or claim denials.

✅ Choosing Non-Owner or Parked Car Insurance

If you’re not driving, these are affordable ways to maintain continuous insurance coverage.

✅ Asking for SR-22 Filing Help

Many insurers handle the filing for you, which simplifies the legal process immensely.

✅ Comparing Multiple Quotes

High-risk drivers can see vast differences between providers. Get at least 3–5 quotes.

Summary and Final Advice

Even with a suspended license, maintaining car insurance is not only possible—it’s necessary. Whether you choose non-owner insurance or file an SR-22 for reinstatement, you have options tailored to your situation. Be proactive, compare quotes, and choose a provider that understands your unique needs.

Need help with license reinstatement or SR-22 insurance? Take action today and start getting quotes from top-rated high-risk providers who work with suspended license cases.

Explore related topics: How to File an SR-22 and Types of High-Risk Auto Insurance.