Studying in the United States as an international student comes with many responsibilities — one of the most crucial being medical insurance for F1 students. While it might seem like just another formality, having adequate health coverage is a fundamental requirement for maintaining your student visa status and protecting yourself from unexpected healthcare expenses. In this comprehensive guide, we’ll walk you through the key aspects of F1 medical insurance requirements, coverage expectations, exemptions, and smart tips for selecting the best insurance policy.

Why Do F1 Students Need Medical Insurance?

Healthcare in the U.S. is notoriously expensive. A single hospital visit can cost thousands of dollars without insurance. Because of this, many U.S. universities and colleges require their international students to carry valid health insurance. Some institutions even auto-enroll students in group plans unless they submit a waiver with proof of equivalent coverage. As an F1 visa holder, not having insurance can lead to serious legal, academic, and financial issues.

University Requirements vs. Government Mandates

It’s important to understand that the U.S. government does not mandate health insurance for F1 visa holders. However, most universities enforce their own rules to protect student well-being and institutional liability. This means you must follow your school’s policy even if it’s stricter than federal guidelines.

What Does a Typical F1 Student Health Plan Cover?

- Doctor visits and hospital stays

- Prescription medications

- Mental health services

- Emergency medical evacuation

- Repatriation of remains

- Pre-existing conditions (after a waiting period in most cases)

Most policies also include telehealth options, 24/7 nurse hotlines, and mobile app management. However, be sure to check the fine print for deductibles, co-pays, and coverage caps.

Types of F1 Insurance Plans Available

1. University-Sponsored Plans

These are offered directly through your institution. They are usually comprehensive but can be more expensive.

2. Independent Private Insurance Plans

You can purchase these from providers like ISO, IMG, or International Student Insurance. These often offer more flexibility and cost-saving options, especially if your school allows waiver submissions.

3. Waiver-Eligible Plans

Many international students opt for cheaper private plans and request a waiver from the university plan. However, this is only possible if the alternative plan meets the institution’s criteria.

Comparison Table: University Plan vs. Private Plan

| Feature | University Plan | Private Plan |

|---|---|---|

| Premium Cost | High | Moderate to Low |

| Coverage | Comprehensive | Varies |

| Customizability | None | High |

| School Approval | Automatic | Requires Waiver |

Top Insurance Providers for F1 Students

- ISO Student Health Insurance

- International Student Insurance (ISI)

- IMG Global

- Compass Student Insurance

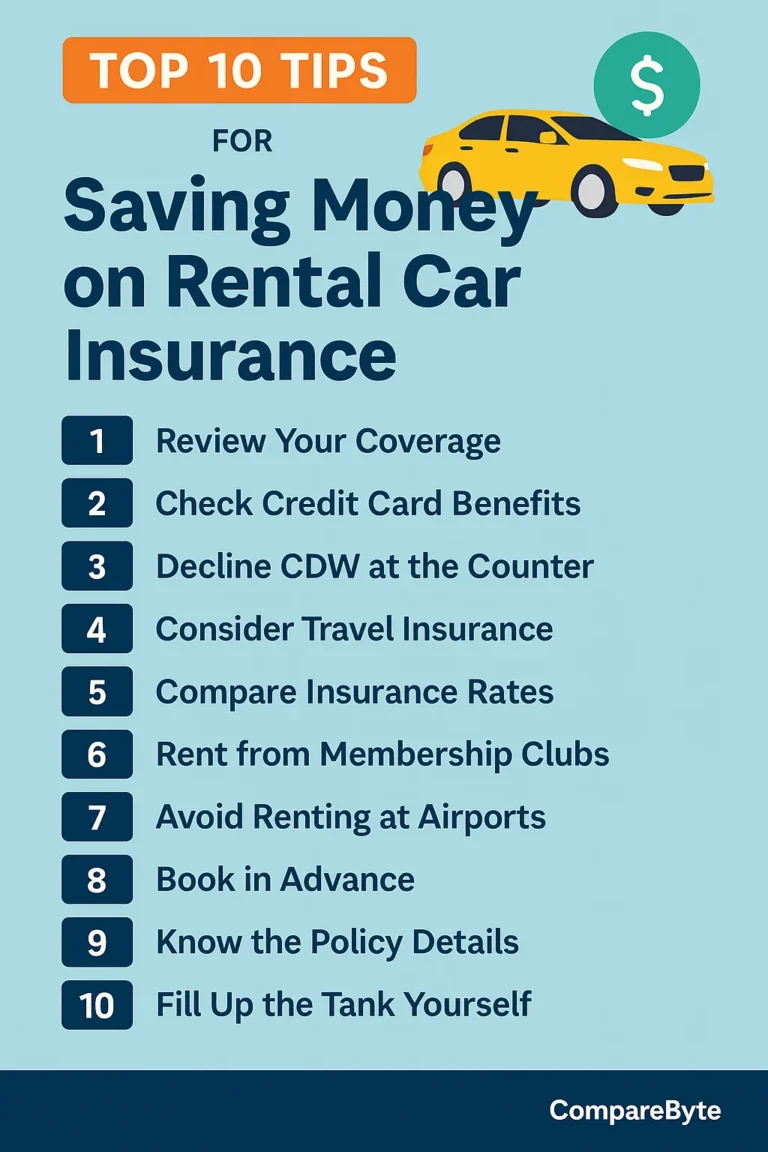

Tips for Choosing the Best Insurance Plan

- Ensure the plan covers all university requirements

- Compare premiums, deductibles, and out-of-pocket maximums

- Look for 24/7 support and multi-language assistance

- Check if the plan is ACA-compliant or not (not always required for F1)

Frequently Asked Questions

Is medical insurance mandatory for all F1 students?

While not mandated by the U.S. government, most universities require health insurance for enrollment.

Can I use travel insurance instead?

Travel insurance typically doesn’t meet school or visa requirements for medical coverage. It’s not a substitute for a proper student health plan.

Can I cancel the university plan?

You may cancel only if your school allows a waiver and your alternative insurance meets all the outlined criteria.

Conclusion

Having the right medical insurance as an F1 student isn’t just a formality — it’s an essential part of securing your future, health, and academic success in the U.S. By understanding the options and requirements, you can confidently choose a plan that protects your well-being while staying compliant with your visa and school policies.