In today’s increasingly digital insurance marketplace, using the best apps to compare insurance policies can significantly impact the quality and affordability of your coverage. These digital tools allow users to evaluate premiums, terms, and insurer reputation all in one place—streamlining the traditionally complex decision-making process. For consumers, this means improved transparency, faster decisions, and ultimately, better financial outcomes.

This guide explores how these apps have evolved, provides statistical performance metrics, compares leading platforms across sectors, outlines future trends, and compiles expert commentary—all geared toward helping readers choose the most efficient insurance comparison app for their specific needs.

History and Evolution of Insurance Comparison Apps

The rise of digital insurance began in the early 2000s, with insurers transitioning from brick-and-mortar agencies to web-based platforms. The first wave of comparison tools was basic, offering simple quote aggregations. These platforms evolved from simple websites into sophisticated insurance comparison apps thanks to mobile proliferation, machine learning, and API integrations.

By 2010, major insurtech companies like Zebra, Gabi, and Policygenius began leveraging user data to personalize results. This transformed the industry, as real-time updates from multiple insurers became standard. By 2015, most apps included additional features such as customer reviews, document uploads, and bundling suggestions for auto, home, health, and life insurance policies.

Modern apps now incorporate AI-based recommendations, fraud detection, behavioral tracking, and even digital assistant support. According to a Deloitte 2023 report, over 67% of policyholders in the U.S. used mobile apps during the purchase or renewal of an insurance policy.

The evolution is not just technological but also regulatory. Insurtechs now operate under stricter compliance guidelines, improving consumer protection and pushing for more transparent algorithms in policy matching.

Current Statistics and App Performance Metrics

| App Name | Monthly Active Users | Average Rating (App Store) | Policy Types Supported |

|---|---|---|---|

| Policygenius | 2.3 million | 4.7/5 | Life, Health, Auto, Renters |

| The Zebra | 1.9 million | 4.6/5 | Auto, Home |

| Gabi | 1.2 million | 4.4/5 | Auto, Home |

| Compare.com | 800,000 | 4.2/5 | Auto |

| Feature | Percentage of Users Prioritizing |

|---|---|

| Ease of Use | 82% |

| Quote Accuracy | 78% |

| Insurer Reputation | 74% |

| Speed of Comparison | 69% |

Sector-Based Comparisons

Auto Insurance

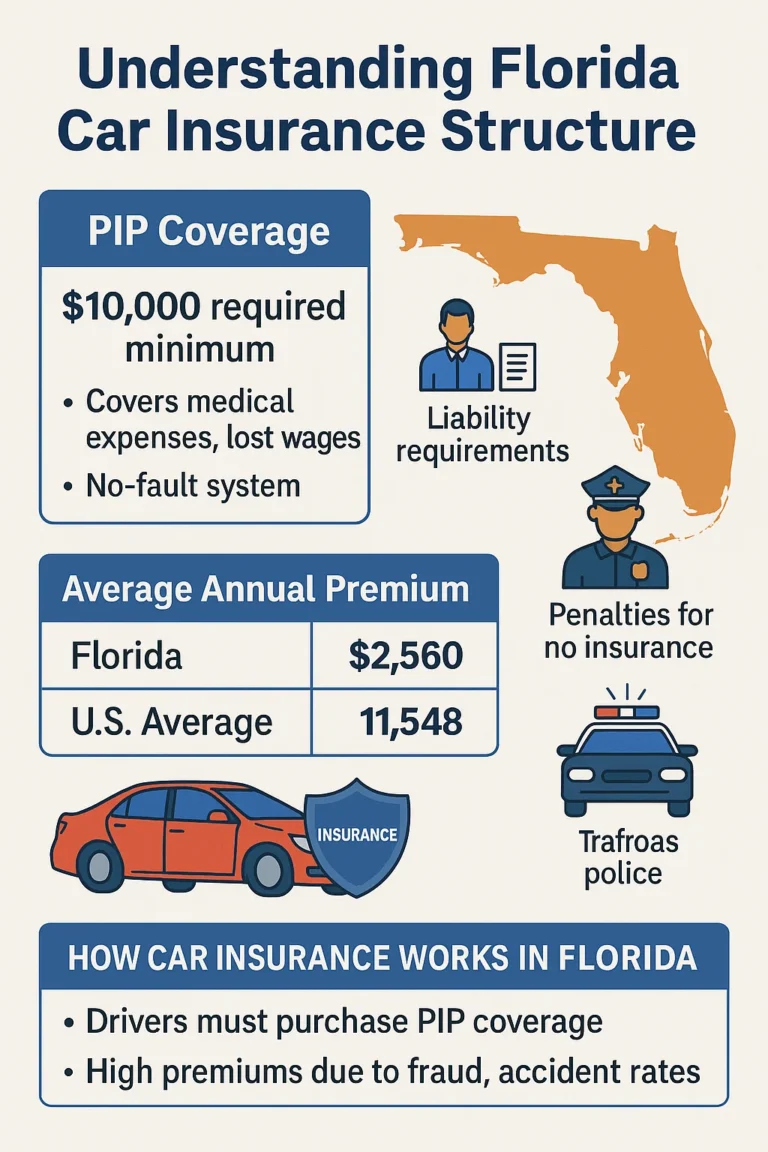

Apps like The Zebra and Gabi dominate the auto insurance comparison space, offering VIN-based matching and policy bundling. Their use of telematics enhances quote precision, aligning with insurer risk models. Consumers benefit from real-time updates and insurer discounts.

Health Insurance

Policygenius stands out in the health insurance domain due to its integration with federal and state exchanges. Users can compare ACA-compliant plans, view HSA compatibility, and explore Medicaid options—all through one interface.

Life Insurance

Term life comparisons are increasingly digital. Apps now include tools for projected needs analysis and provide access to brokered policies without upselling. Platforms like Policygenius Life Insurance tailor recommendations based on age, health, and dependents.

Future Trends and Forecasts

Experts forecast a 15% CAGR in insurtech app adoption through 2030. AI-driven personalization will dominate the landscape, with predictive analytics replacing static questionnaires. Expect deeper integrations with wearable tech and IoT devices—especially in auto and health segments.

Voice assistants are also predicted to enter the comparison app market, allowing users to request quotes via Alexa, Siri, or Google Assistant. Regulatory bodies may require more transparent AI audit trails to avoid biased recommendations.

Data privacy will remain a focal issue. Platforms will need to adopt zero-knowledge encryption and blockchain verification, especially as users store sensitive personal and financial data.

Expert Opinions and Academic Citations

According to McKinsey’s 2023 Digital Insurance Report, “the role of comparative apps in shaping consumer choice has been as transformational as price comparison in the airline industry.” The study emphasizes the rise in first-time policyholders who trust digital-first solutions over agents.

Dr. Elena Martin, a professor at NYU’s Stern School of Business, highlights that “apps reduce information asymmetry, enabling smarter policy selection—especially for Gen Z consumers, 74% of whom prefer app-based financial management.” (NYU Research)

Further, industry insights from Insurtech Insights provide continual data tracking and growth forecasts.

Conclusion and Summary

As the insurance market becomes increasingly digitized, comparison apps play a vital role in reshaping how consumers select and manage policies. From AI recommendations to real-time quote accuracy, these tools represent the future of personal insurance management. Choosing the best insurance comparison app depends on your policy type, coverage needs, and digital fluency.

To explore more about policy savings strategies, visit our related guides: How to Lower Your Car Insurance Premium and Choosing Between Term and Whole Life Insurance.

Frequently Asked Questions

- What is the most accurate insurance comparison app?

- Apps like Policygenius and The Zebra are rated highly for quote accuracy and breadth of insurers.

- Can I buy policies directly through these apps?

- Yes, most modern apps allow in-app purchases or redirect to insurer portals seamlessly.

- Are insurance comparison apps free to use?

- Yes, most are completely free. They earn commissions from insurers without affecting user pricing.

- Do these apps work internationally?

- Some apps, like Compare the Market UK, cater to non-US audiences. Check local availability before use.