Getting hit with an unexpectedly high insurance premium can feel like a punch to the wallet. Whether you’re a student, a new driver, or someone who recently moved, understanding the factors that impact your premium is essential. In this guide, we’ll break down the pros and cons of high insurance premiums, explain why you might be paying more than others, and offer actionable tips to fix it.

Common Reasons Why Your Premium Is Higher Than Expected

Before diving into the pros and cons, let’s look at some common reasons your insurance premium might be higher than you’d like:

- 📍 Location: Living in urban areas with high traffic and crime rates increases risk.

- 🧾 Credit Score: Lower credit often translates to higher premiums.

- 🚘 Vehicle Type: Sports cars and newer models are more expensive to insure.

- 🧑💼 Age and Experience: Drivers under 25 or with less than 3 years’ experience pay more.

- 📊 Driving History: Tickets, claims, or accidents within the last 3–5 years increase your risk profile.

Comparison Table: High vs Low Risk Factors

| Risk Factor | High-Risk Scenario | Low-Risk Scenario |

|---|---|---|

| Location | New York City (urban, high theft) | Suburban Ohio (low traffic) |

| Vehicle | 2023 Dodge Charger | 2010 Toyota Corolla |

| Age | 19 years old, new driver | 32 years old, 10+ years experience |

Pros of Higher Insurance Premiums

- ✅ More Comprehensive Coverage: Higher premiums often mean better protection.

- ✅ Lower Deductibles: You pay less out of pocket when filing a claim.

- ✅ Extra Features: Roadside assistance, rental car coverage, and more may be included.

Cons of Higher Insurance Premiums

- ❌ Financial Strain: Paying too much monthly may hurt your budget.

- ❌ Overpaying for Risk: Insurers may be overestimating your risk profile.

- ❌ Limited Provider Options: Fewer companies may be willing to compete for your policy.

Is a High Premium Ever Justified?

Yes — in some cases, the extra cost brings peace of mind. For example, if you live in a storm-prone area or drive a newer luxury vehicle, paying more may protect you from expensive repairs or theft. But if you have a clean record and still pay a lot, it may be time to review your coverage.

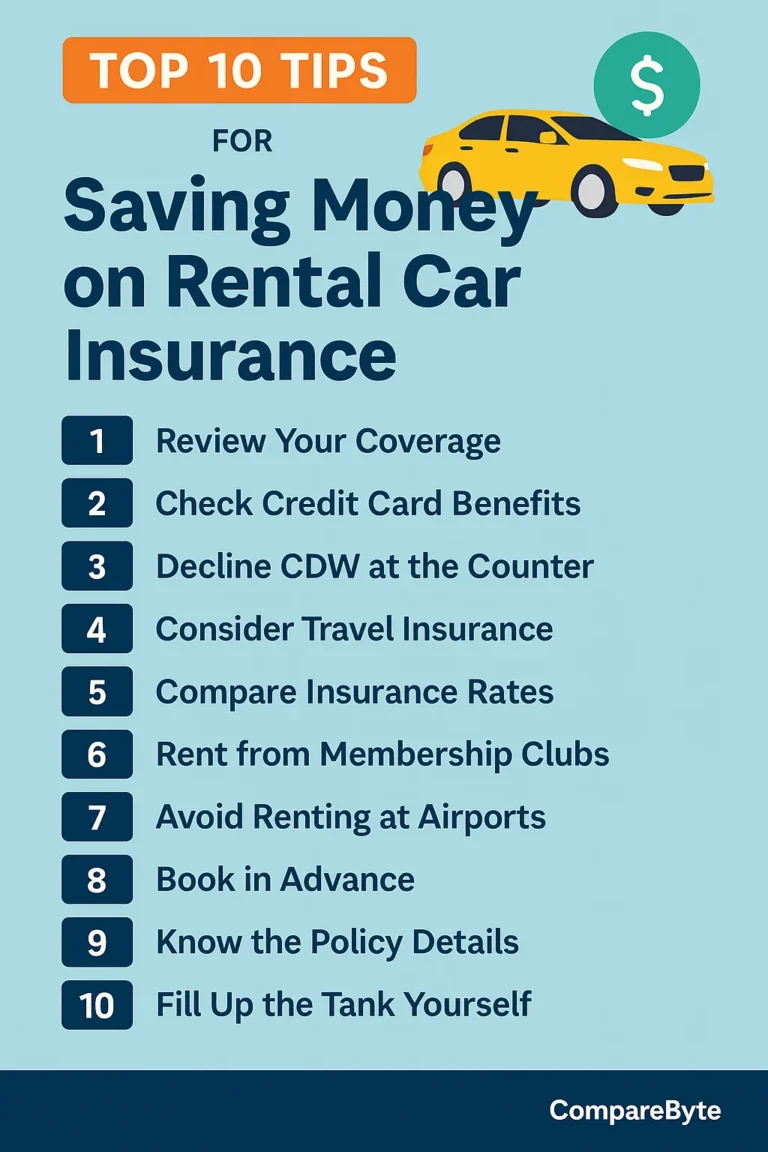

How to Reduce Your Premium Without Losing Coverage

- Shop Around: Compare quotes from at least 3–5 providers annually.

- Improve Your Credit: Raising your credit score even slightly can reduce your rate.

- Ask About Discounts: Good student, low mileage, safe driver — ask for them all.

- Adjust Your Deductibles: Raising your deductible can lower your monthly payment.

Quick FAQ

Does age always affect your premium?

Yes, especially for drivers under 25 and over 70. Age is a major risk factor in pricing models.

Can I negotiate my premium?

You can’t directly negotiate, but comparing providers and asking for discounts gives you leverage.

Conclusion

High insurance premiums aren’t always bad — but they should always be justified. Knowing what you’re paying for, comparing your options, and actively managing your profile can make all the difference. Whether you decide to adjust coverage or switch providers, the key is to stay informed and proactive.

Compare Rates and Save More

Use CompareByte to get the best quotes based on your actual profile — not assumptions. Let data work for your budget.