Choosing the right car insurance provider can be a daunting task for students, especially when considering giants like Progressive and GEICO. Both companies are known for their competitive rates, comprehensive coverage, and strong reputations. However, students often have unique needs that differ from the average driver. This article explores a detailed comparison of Progressive vs GEICO, focusing on the top 10 aspects students care about most. From cost and discounts to digital tools and customer satisfaction, we’ve got it all covered.

1. Pricing and Affordability

For most students, budget is the primary concern. Both Progressive and GEICO offer relatively low rates compared to other providers. However, GEICO tends to offer cheaper base premiums, particularly for younger drivers. Progressive, on the other hand, provides a variety of bundling options that can reduce overall cost. Depending on your location and driving history, the price difference can range from 5% to 20% in favor of GEICO.

2. Discounts for Students

GEICO has a slight edge here with their “Good Student Discount” and “Driver’s Ed Discount”. Progressive also offers a good student discount, but it’s not as generous as GEICO’s. Moreover, GEICO’s discounts are more accessible for part-time students as well.

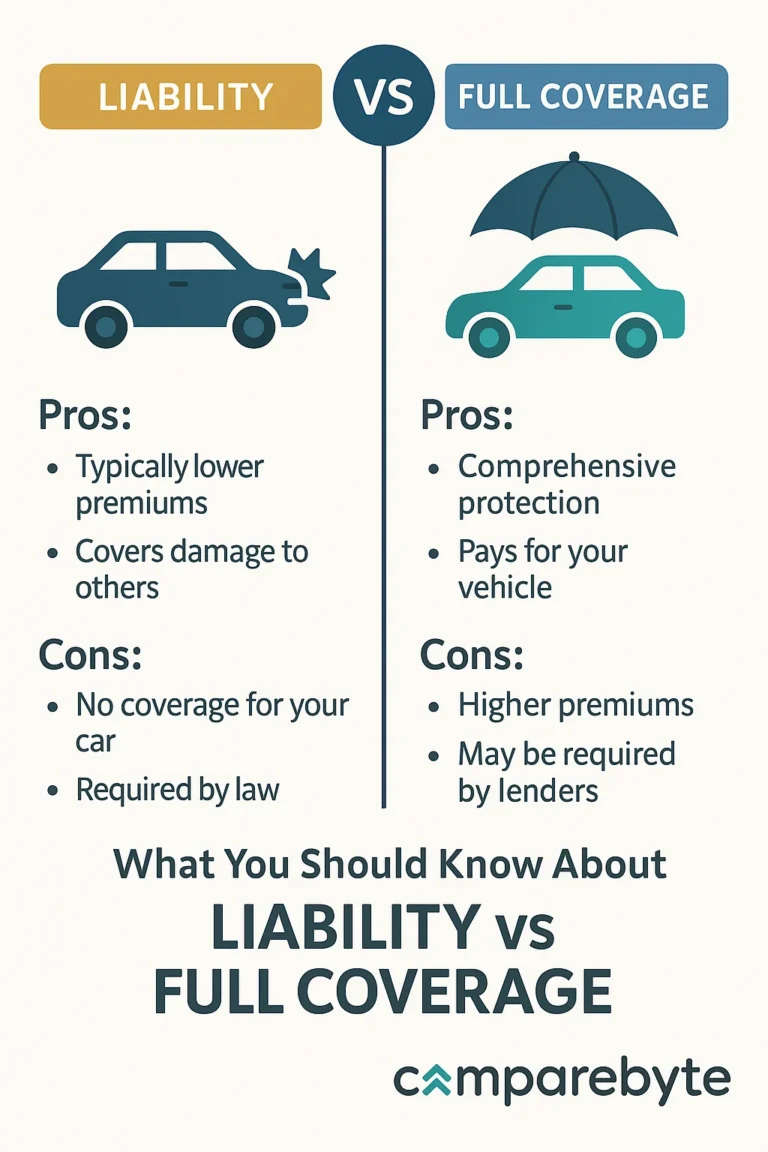

3. Coverage Options

Progressive offers a wider range of optional coverages such as gap insurance, custom parts coverage, and rideshare insurance. Progressive shines in customization, allowing students to tailor their policy more specifically to their needs. GEICO, while offering solid standard coverage, falls slightly behind in the variety of optional extras.

4. Mobile App and Digital Tools

Both providers have robust apps, but Progressive’s app is more feature-rich, allowing for easier policy management and claims submission. However, GEICO’s app is more user-friendly and intuitive, especially for first-time users.

5. Customer Satisfaction

According to J.D. Power’s latest ratings, GEICO slightly outperforms Progressive in terms of overall customer satisfaction. Students who value ease of communication and reliable support may prefer GEICO.

6. Claim Process

Progressive is known for a faster, smoother claims process. They provide real-time updates and a network of certified repair shops. For students who value efficiency, Progressive has the edge here.

7. Availability Across States

Both companies are available in all 50 states. However, GEICO has better localized pricing in states like Texas, Florida, and California—popular hubs for students.

8. Financial Stability

Both Progressive and GEICO have A++ ratings from AM Best, indicating strong financial stability. This factor is crucial for students who want long-term reliability.

9. Roadside Assistance and Add-ons

Progressive includes more in their roadside assistance package, such as fuel delivery and towing. GEICO offers this as well, but it’s often more basic unless you opt into add-ons.

10. Overall Value

When all is said and done, GEICO may be better for students on a tight budget who want reliable, straightforward coverage. Progressive suits students who desire a customizable experience and advanced features, even if it comes at a slightly higher price.

Final Thoughts

Choosing between Progressive and GEICO ultimately comes down to your personal preferences and priorities. Students looking for low premiums and good discounts will likely lean towards GEICO, while those interested in broader coverage and tech-savvy features might prefer Progressive. Always compare quotes, read policy fine print, and use online comparison tools before making a decision.