Thinking about switching your auto insurance provider? You’re not alone. Every year, millions of drivers reconsider their insurance needs, either due to increasing premiums, poor service, or better offers elsewhere. But making the change isn’t as simple as canceling one policy and signing up with another.

This guide outlines the top 10 steps to follow when switching car insurance companies, along with detailed tips, comparison tables, and real-world insights to ensure a smooth transition.

Why Consider Switching Auto Insurance?

Many drivers remain with the same insurer for years without reevaluating their coverage or comparing rates. However, this loyalty often leads to missed opportunities for savings and better protection. Here are some of the most common reasons drivers make the switch:

1. Rising Premium Costs

One of the biggest motivators for change is the increased cost of premiums. Over time, insurance companies may gradually raise rates, even if your driving record remains clean.

2. Better Customer Service

Customer service plays a major role in satisfaction. Switching to a provider with better support and faster claims processing is a smart move.

3. Policy Flexibility

Some insurers offer more flexible policies or bundling discounts when combining auto, home, or life insurance.

4. New Driving Habits or Life Events

Got married? Moved to a new state? Bought a new car? These changes may qualify you for lower premiums with another provider.

Top 10 Steps to Switch Your Auto Insurance Provider

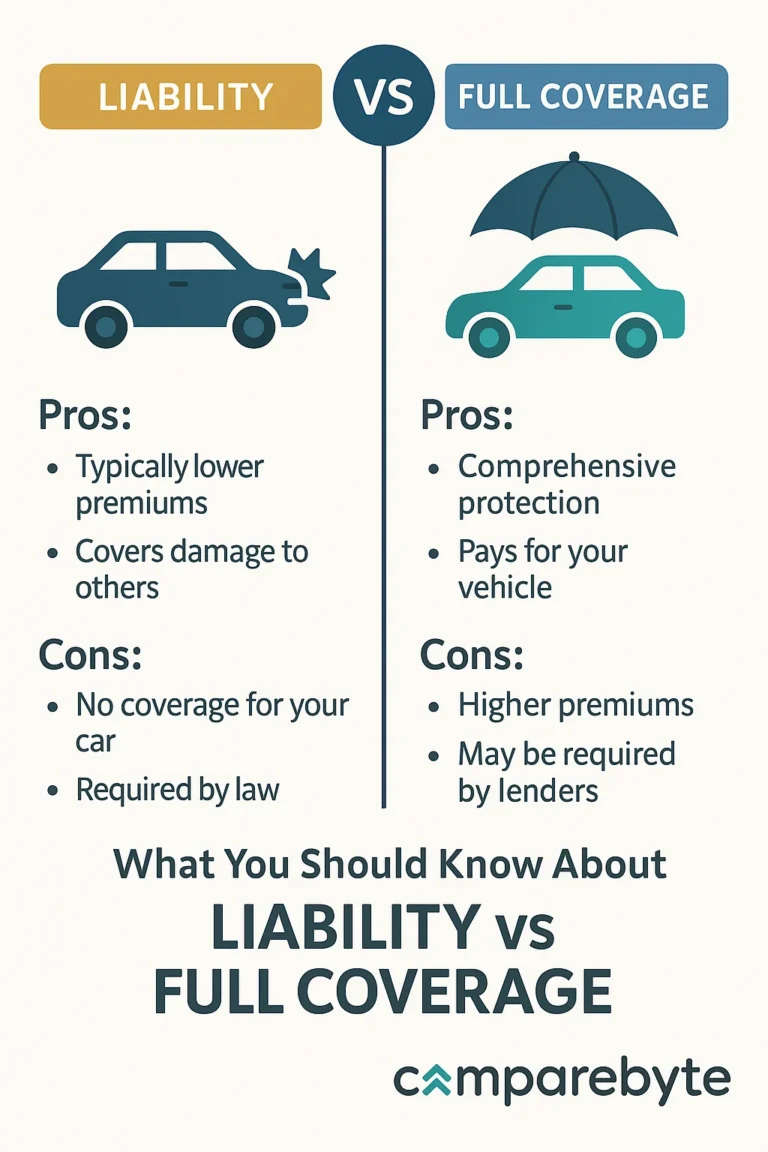

1. Evaluate Your Current Policy

Understand what you’re paying for

Review your current coverage, deductibles, and limits. Identify gaps or unnecessary features that are driving up your costs.

2. Research New Providers

Compare at least three insurers

Use online tools like PolicyGenius or The Zebra to get quotes and compare services side by side.

3. Check for Hidden Fees or Cancellation Charges

Read the fine print

Your current insurer might charge a fee for early cancellation. Weigh this against potential savings before proceeding.

4. Time the Switch Carefully

Avoid coverage gaps

Always activate the new policy before canceling the old one to ensure you remain legally covered at all times.

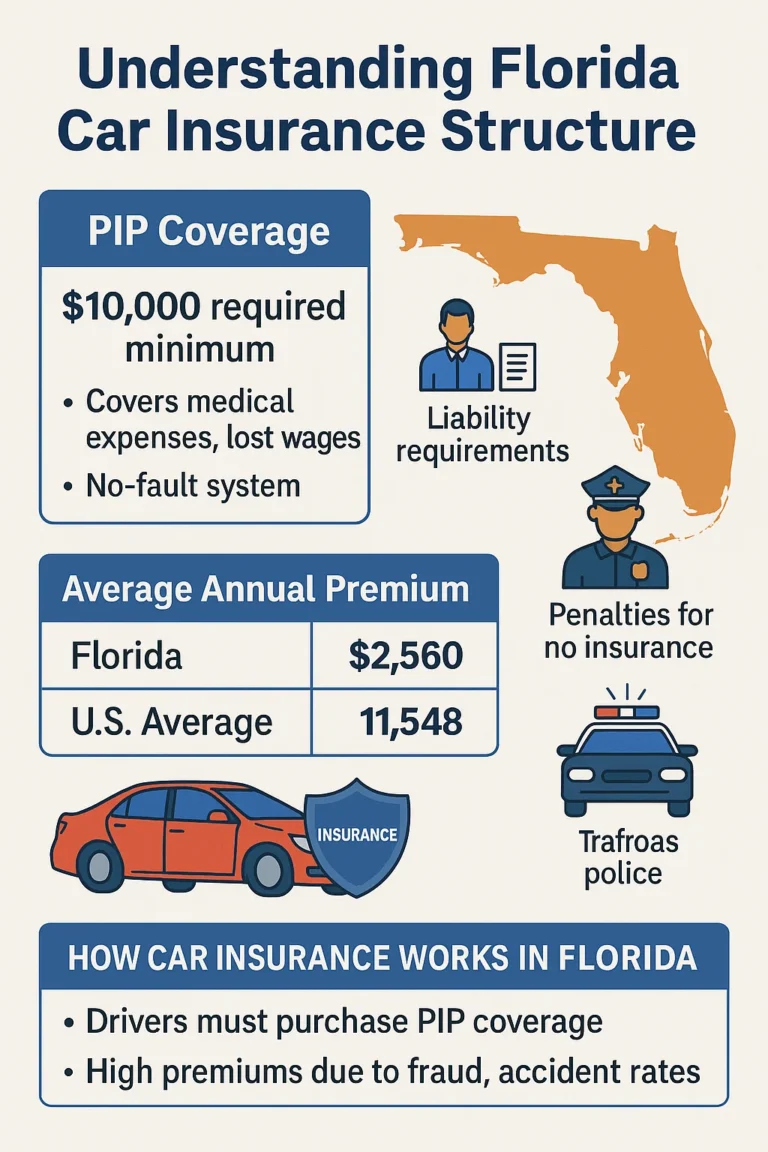

5. Verify State Requirements

Each state has its own minimum coverage laws

Make sure your new policy complies with your state’s regulations to avoid fines or license suspension.

6. Ask for Discounts

New customers may qualify for special rates

Many companies offer multi-policy, good driver, student, and military discounts. Always ask what’s available.

7. Bundle Your Insurance

Combine policies for savings

Providers often reward customers who combine home, renters, or life insurance with their auto policy.

8. Inform Your Lender (If Financing)

Required for leased or financed vehicles

Send proof of your new policy to your lender to avoid coverage lapses or penalty charges.

9. Cancel the Old Policy

Do this only after the new policy is active

Submit your cancellation in writing and confirm receipt to avoid being double-billed.

10. Print and Keep Proof of Insurance

Keep a copy in your vehicle

Carry a digital or physical copy of your new proof of insurance at all times to comply with legal requirements.

Comparison Table: Top Auto Insurance Providers

| Provider | Average Annual Cost | Customer Satisfaction (J.D. Power) | Best For |

|---|---|---|---|

| Geico | $1,182 | 835/1000 | Budget-Friendly Plans |

| State Farm | $1,319 | 848/1000 | Customer Service |

| Progressive | $1,533 | 819/1000 | Customizable Coverage |

Pros and Cons of Switching Providers

| Pros | Cons |

|---|---|

| Potential cost savings, better coverage options, and enhanced customer support | Risk of policy gaps, learning a new claims system, and possible cancellation fees |

Frequently Asked Questions

Is there a best time of year to switch car insurance?

While there’s no universal “best time,” many people switch before renewal dates or during major life changes (e.g., moving, buying a new car).

Will switching insurance affect my credit score?

No, most insurers use a “soft pull,” which does not impact your credit score.

Do I need to notify my current provider?

Yes, and you should do so in writing. Confirm that your policy is canceled and request any eligible refund.

Conclusion and Summary

Switching your auto insurance provider is a smart move when done with proper research and planning. From identifying better rates to accessing improved customer support, the benefits can be significant. However, make sure to avoid coverage gaps, understand all cancellation fees, and keep documentation at every stage.

By following the ten steps outlined in this guide, you can confidently transition to a new insurer without unnecessary stress or risk.

Compare Auto Insurance Rates | Best Car Insurance for Young Drivers