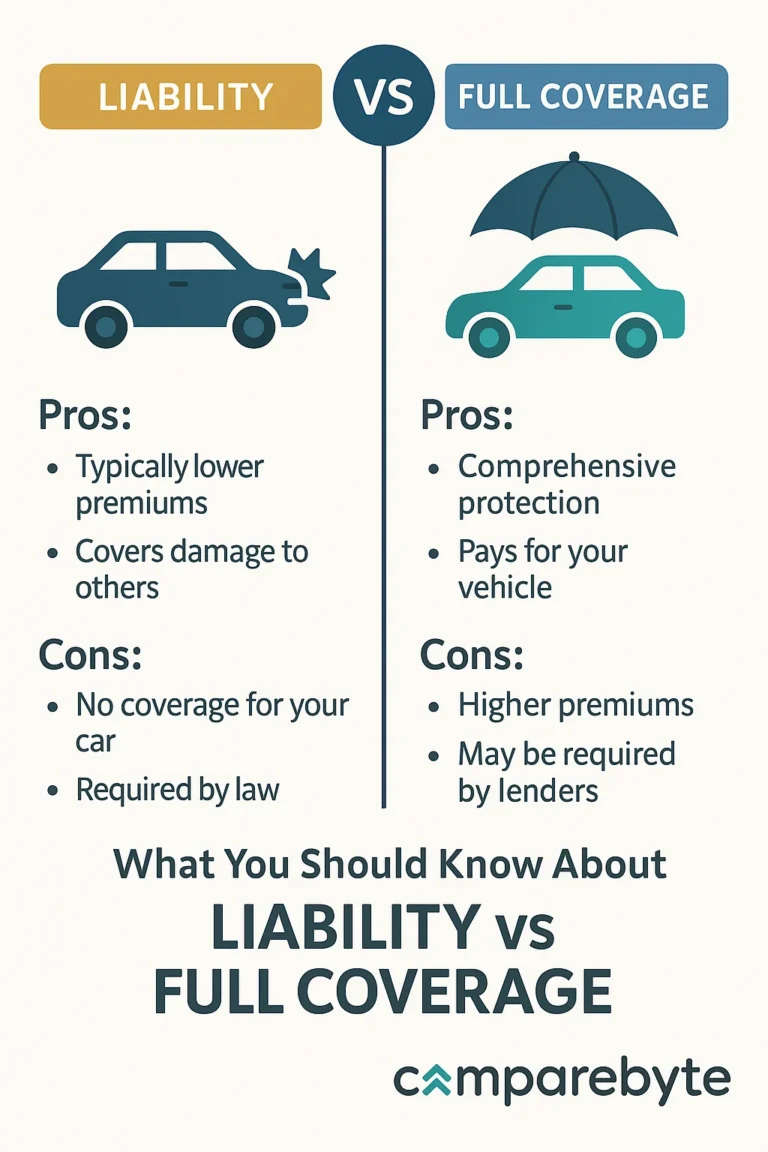

Choosing between liability insurance and full coverage is one of the most important decisions a car owner can make. The two options differ significantly in terms of protection, cost, and legal requirements, making the right choice dependent on your personal situation, financial security, and driving habits.

This guide explores the top 10 key differences between liability and full coverage insurance. It offers a side-by-side analysis, real user scenarios, and advice on choosing the right plan for your needs.

Understanding the Features of Liability and Full Coverage

What is Liability Insurance?

Liability insurance is the minimum legal requirement in most U.S. states. It covers damages and injuries you cause to others in an accident. However, it does not protect your own vehicle or medical expenses.

This type of insurance typically includes two components: bodily injury liability and property damage liability. Bodily injury helps pay for medical expenses of the other party, while property damage covers repairs to their vehicle or property.

Liability insurance is best for older vehicles or drivers with a tight budget. It satisfies legal requirements but leaves the insured responsible for their own losses.

Premiums are generally lower compared to full coverage, but the potential out-of-pocket costs in an accident could be high.

What is Full Coverage Insurance?

Full coverage insurance is a combination of different types of coverage: liability, comprehensive, and collision. It provides financial protection for both third parties and your own vehicle.

Comprehensive coverage includes protection against non-collision events like theft, vandalism, fire, or weather damage. Collision coverage pays for damage to your car in an accident regardless of fault.

Full coverage is highly recommended for new or financed cars. Lenders often require it until the loan is paid off.

While premiums are higher, it offers peace of mind and can help avoid significant out-of-pocket expenses after an accident or unexpected event.

Advantages and Disadvantages Comparison

| Feature | Liability Insurance | Full Coverage |

|---|---|---|

| Cost | Low | High |

| Coverage Type | Third-party only | Third-party + personal damages |

| Vehicle Protection | No | Yes |

| Required for Financing | No | Yes |

| Out-of-pocket Risk | High | Low |

| Scenario | Recommended Option |

|---|---|

| Driving a 10-year-old car | Liability |

| Financing a new car | Full Coverage |

| Living in a high-theft area | Full Coverage |

| Retired driver with no commute | Liability |

Which Option is Better for Your Situation?

New Vehicle Owners

If you’ve recently purchased a new vehicle, especially on a loan or lease, full coverage is often a must. It protects your investment and ensures you’re not left with repair costs on a new car.

Budget-Conscious Drivers

For drivers looking to minimize monthly premiums, liability insurance offers basic legal compliance. However, this comes with higher risk in case of personal vehicle damage.

High-Risk Driving Areas

Those in urban areas with higher accident or theft rates should consider full coverage to avoid expensive losses from theft, vandalism, or natural disasters.

Real User Experiences

Mike from Ohio shares: “I switched to full coverage after someone sideswiped my car and took off. The $400 more per year is worth the peace of mind.”

Jessica in Florida says: “I’ve used liability for years. My car’s not worth much, and it keeps my insurance bill under $60 a month. I’d rather save the cash.”

Ali from California explains: “Full coverage saved me after a tree fell on my parked car. The payout covered my deductible and then some.”

Conclusion: Making the Right Choice

Ultimately, the decision between liability and full coverage depends on your car’s value, your budget, and your risk tolerance. While liability meets basic legal requirements, full coverage offers broader protection that can be financially life-saving.

Evaluate your needs carefully and consider speaking with an insurance agent for tailored advice. Compare multiple quotes using reputable tools such as PolicyGenius or The Zebra.

Want to learn more? Check out our guides on Best Online Insurance Marketplaces and Common Mistakes When Choosing Insurance.

Ready to save? Start comparing quotes now and protect what matters most!